Historic Test Ahead: Ethereum Nears Its All-Time High Amid Retail Sell-Offs

Ethereum is closing in on a historic test, hovering just 6.4% below its all-time high of $4,891. Despite persistent sell-offs from retail traders, the asset’s upward momentum continues, signaling a potential breakthrough that could set the stage for new record levels.

Retail Sentiment Misfires: Lessons From Past Greed And Corrections

Santiment, a popular platform in on-chain and market analytics, recently highlighted in a post that Ethereum is now within striking distance of a historic milestone — just 6.4% away from its all-time high of $4,891 set on November 16, 2021.

This approach toward record territory has been accompanied by a surprising trend: retail traders are consistently selling off their holdings even as the second-largest cryptocurrency by market cap pushes higher. The divergence between price action and retail sentiment is becoming increasingly notable in this rally.

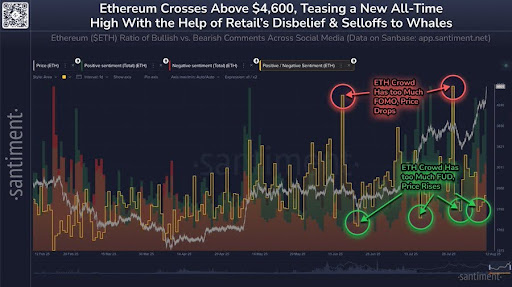

When smaller market participants become overly optimistic, prices tend to cool off; conversely, when fear and skepticism prevail, the market often continues its upward march. This pattern has played out multiple times in the past, making the current wave of selling from retail traders a potentially bullish signal.

Santiment also pointed to previous scenarios to support this observation. On June 16, 2025, and again on July 30, 2025, Ethereum experienced periods of extreme retail greed, which were followed by sharp corrections as the market recalibrated. These historical instances underline the contrarian nature of market psychology, where excessive optimism can precede pullbacks, while disbelief and hesitation can pave the way for price growth.

In the current rally, retail sentiment has been marked by FUD (fear, uncertainty, and doubt) and disbelief. Despite Ethereum consistently printing higher highs, many traders remain convinced that the move is unsustainable.

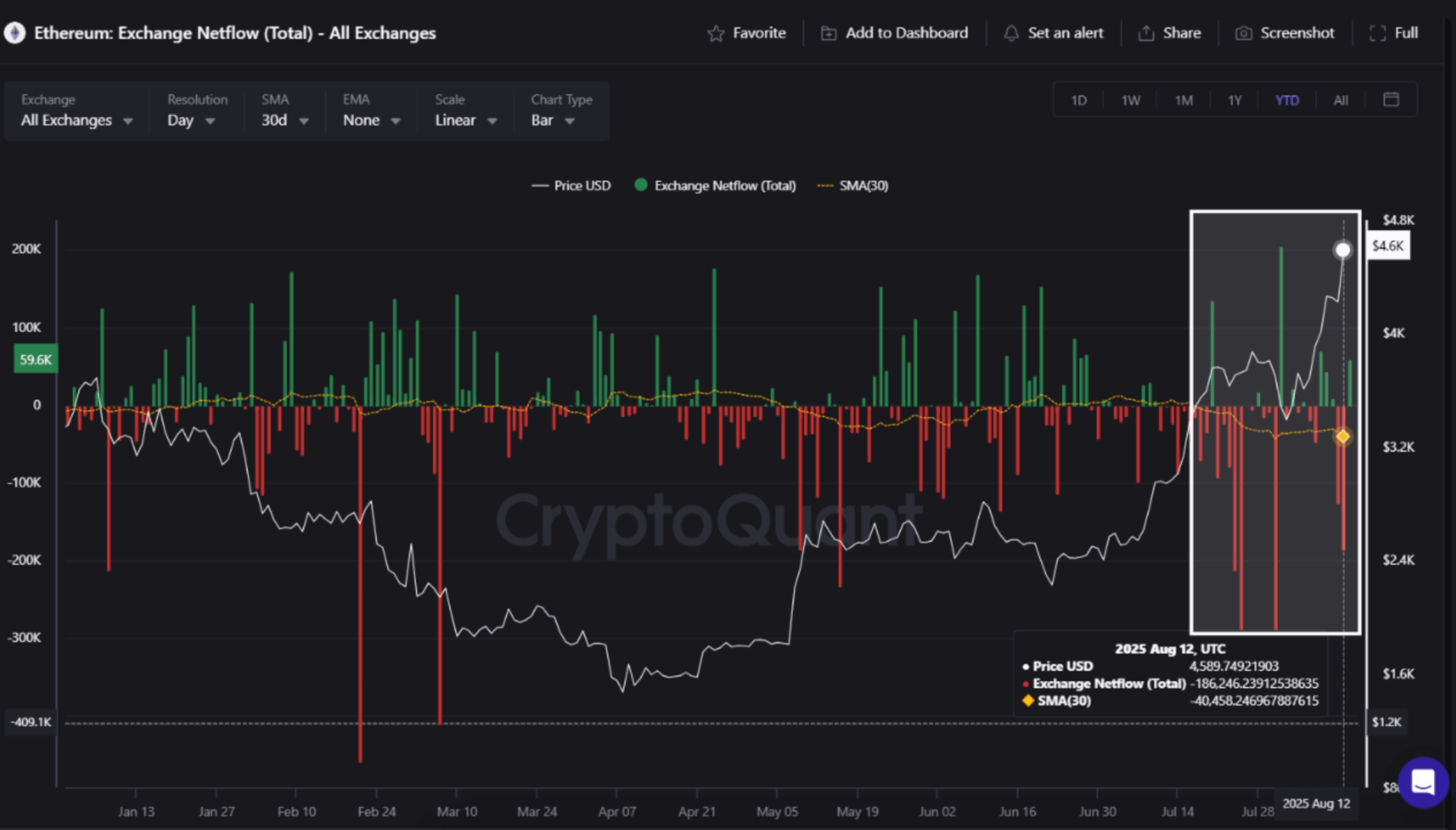

Loose Coins Changing Hands as Ethereum Eyes Historic Breakout

This emotional disconnect between sentiment and price action may be providing fuel for Ethereum’s continued ascent, as stronger hands — particularly institutional players and large-scale investors — absorb the supply being offloaded by smaller traders. If the current dynamics persist, a break above $4,891 could happen sooner than many expect, potentially marking a significant chapter in Ethereum’s market history

The platform further noted that major stakeholders have been actively accumulating Ethereum, taking advantage of the coins that smaller traders are currently willing to sell. This quiet but steady accumulation suggests that larger players are positioning themselves for a potential breakout.

With minimal sentiment-based resistance in the market, prices appear well-positioned to push higher. If this trend continues, Ethereum could break through its previous all-time high and set new records in the near future, marking a historic moment for the asset.

Analyst Picks Dogecoin As His Top Altcoin Right Now

Crypto analyst CryptoInsightUK has promoted Dogecoin as one of the top altcoins right now, anchoring...

Ethereum Average Daily Outflow Hits 40,000 ETH Amid Rising Buying Pressure – Details

As Ethereum (ETH) trades within striking distance of its all-time high (ATH), on-chain data shows th...

Whales Scoop Up 1B DOGE as Golden Cross Forms: Confidence Build up for the Next Moon Mission?

Dogecoin (DOGE) is riding a fresh wave of bullish momentum after whales scooped up 1 billion DOGE, w...