Crypto Is Here To Stay—Even The SEC Can’t Do Anything About It, Analyst Says

The US markets have seen a surge of digital coins. Millions of Americans now hold tokens in their wallets. Blocking all of it suddenly would be nearly impossible. At the same time, leaving this sector with no rules puts everyday investors in harm’s way.

Why Ban Is Off The Table

According to Bloomberg columnist Matt Levine, outright banning crypto is off the table. He points out that tens of millions of people own digital assets today.

Pulling the plug now would ripple through trading platforms, payment apps, and even major Wall Street firms. Levine argues that such a move would simply drive innovation and jobs offshore.

Hostile Past Still Looms

Under former SEC Chair Gary Gensler, most tokens were treated as stocks. That meant they needed to register under securities laws—a process that almost no project could clear.

In practice, that stance rendered crypto “illegal” in the US. Many developers and investors felt shut out.

Matt Levine: “We will ban crypto” is no longer feasible for the SEC, and “we will ignore crypto because it’s not a security so not our problem” is not very attractive for the SEC. The only choice left is “we will regulate crypto, but in a way that you like. pic.twitter.com/hBFXTmMnh5

— Sar Haribhakti (@sarthakgh) August 7, 2025

According to analysts, crypto serves two purposes: it powers networks and it offers investment chances. That split role creates regulatory headaches.

Many tokens act much like shares in a company, yet they also run on open software and community rules. The SEC knows how to protect stock investors, but digital coins need different safeguards.

Project Crypto Signals Change

Project Crypto Signals Change

Current SEC Chair Paul Atkins launched “Project Crypto” this year. The goal is to carve out faster, clearer paths for token registration.

Projects that truly function as securities could follow a new, streamlined process. At the same time, tokens used mainly for network services would face lighter requirements.

Levine warns that drawing clear lines won’t be easy. How do you tell a governance token from a pure utility token? What level of disclosure makes sense when code can update itself overnight?

Those questions will test regulators and industry alike. However, having defined categories would guide honest developers and protect small investors.

The SEC now faces a clear choice: use its power, but adapt its toolkit. A full ban would leave retail holders stranded. Total hands-off would leave them exposed to fraud.

Featured image from Meta, chart from TradingView

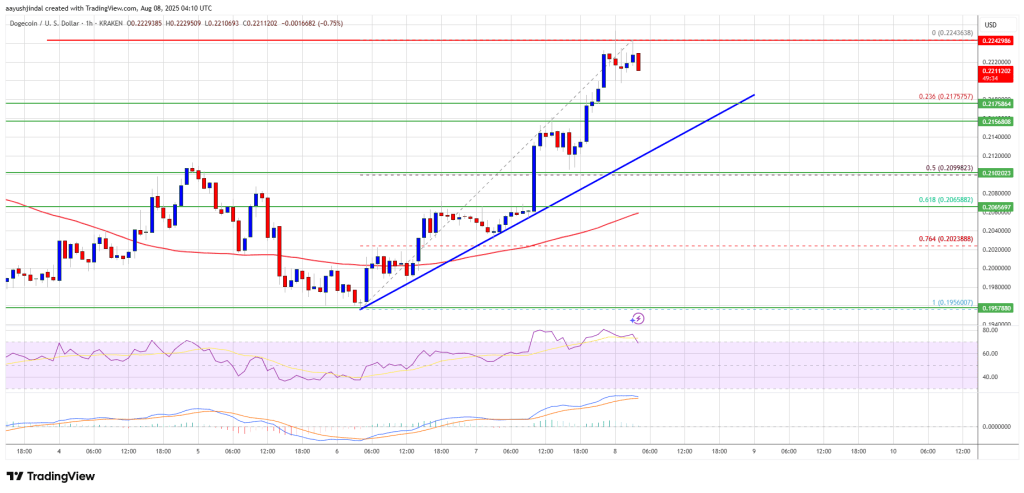

Dogecoin (DOGE) Advances Boldly—Is a Surge Just Around the Corner?

Dogecoin started a fresh increase from the $0.1950 zone against the US Dollar. DOGE is now consolida...

Ethereum Breakout Is ‘Imminent’ Amid $3,850 Retest – Analyst Eyes $5,000 For This Quarter

Ethereum (ETH) is attempting to break out of a crucial resistance level after recovering from last w...

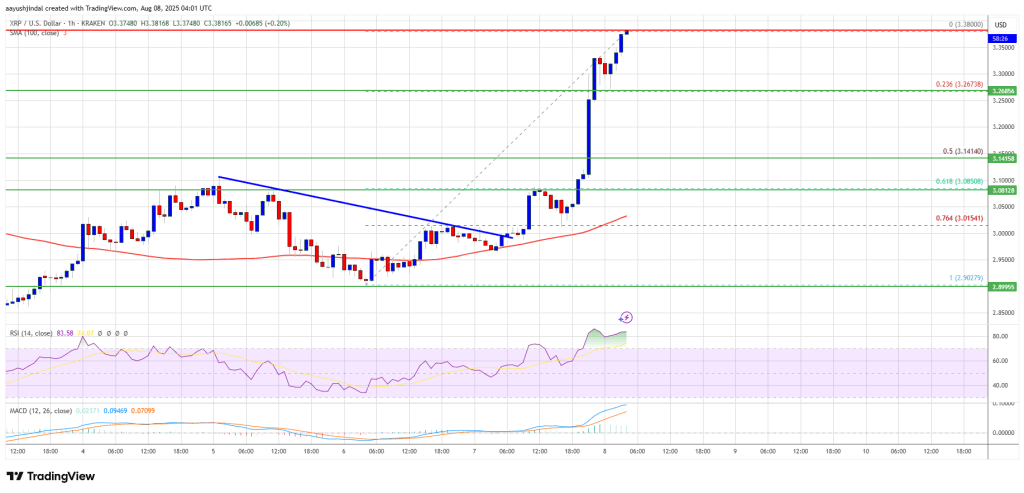

XRP Price Blasts Higher by 10%, Bulls Eye Even Bigger Gains

XRP price is gaining pace above the $3.10 zone. The price is up over 10% and might extend gains abov...