Against The Grain: Analyst Targets $300K Bitcoin Price—When Will It Happen?

A well-known Bitcoin analyst is charting a path that most traders don’t expect. According to reports, the pseudonymous quant strategist PlanB told his 216,000 YouTube subscribers he believes Bitcoin will climb to at least $300,000 by the end of 2026.

That’s a bold call, given that 60% of market participants think the world’s largest cryptocurrency won’t hit that mark in just one and a half years.

Contrarian Price View

Based on his stock-to-flow model, PlanB says Bitcoin’s built-in scarcity drives long-term value. He argues the model points toward an average of $500,000 per coin after the next halving.

The stock-to-flow setup gives a wide range—from $250,000 at the low end to $1 million at the high end—but PlanB believes the center of that range is where Bitcoin is headed. His view flips the script on most forecasts today.

The analyst is also keeping an eye on Bitcoin’s realized price. This metric looks at the price at which recent cohorts of coins last moved on-chain, then divides by the total supply.

Since the current market price of $114,150—up 1% on the day—sits above every major cohort band, PlanB sees a classic bull-market pattern with no bear-market warning signs in sight.

Market Forecasts Show Wide Range

Based on data from price-forecast services, Bitcoin may average $112,000 this month of August, peaking near $114,800 and dipping to around $109,000.

For September 2025, forecasts narrow to a band between $111,000 and $112,400, with an average close to $111,7002. Into 2026, some models see steady gains toward $194,000 by December, with highs above $225,000.

Big Names Offer Mixed Views

Big Names Offer Mixed Views

According to market watchers, Anthony Scaramucci expects Bitcoin to top $170,000 within the next year. US President Donald Trump has not weighed in on crypto recently.

Cathie Wood has her sights on $1 million per coin over the next five years. Digital Coin Price forecasts a swing to about $119,860 by mid-August 2025, then longer-term gains into the $210,000–$230,000 range during 2025.

Meanwhile, Michael Saylor, Strategy Chairman, says Bitcoin’s limited supply and growing institutional interest could push it to $10 million, sparking fresh debate over its long-term role as a global asset.

What It Means For InvestorsBased on analysis, investors should remember that models are tools, not guarantees. PlanB’s $300,000 call sits at the optimistic end of the spectrum. Others see more modest moves, while some have even larger long-term hopes.

Whether Bitcoin follows its past cycles or breaks new ground, it’s clear the debate over its next big run is only getting started.

Featured image from Meta, chart from TradingView

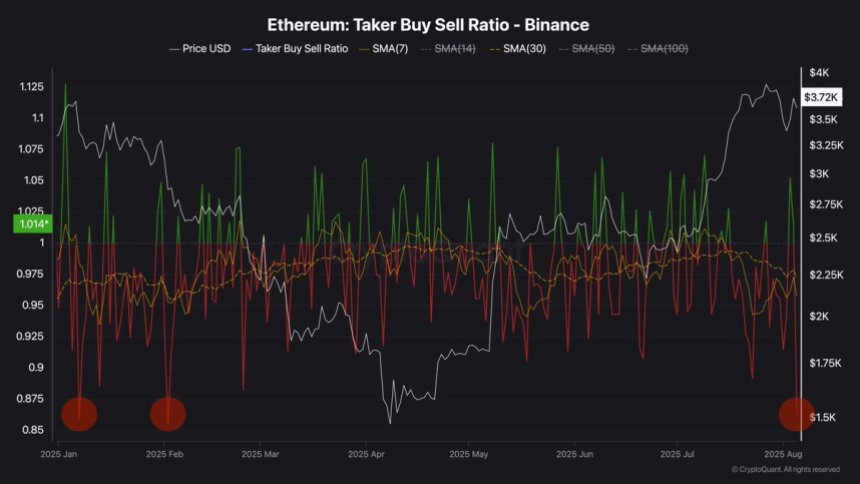

Ethereum Consolidation Deepens As Taker Buy/Sell Ratio Hits One Of The Lowest Levels This Year

Ethereum (ETH) has been facing heightened volatility over the past week, following a sharp correctio...

Cardano Marks Historical Milestone With Governance Vote, Hoskinson Reacts

Cardano (ADA) has achieved a significant milestone with the successful completion of its first-ever ...

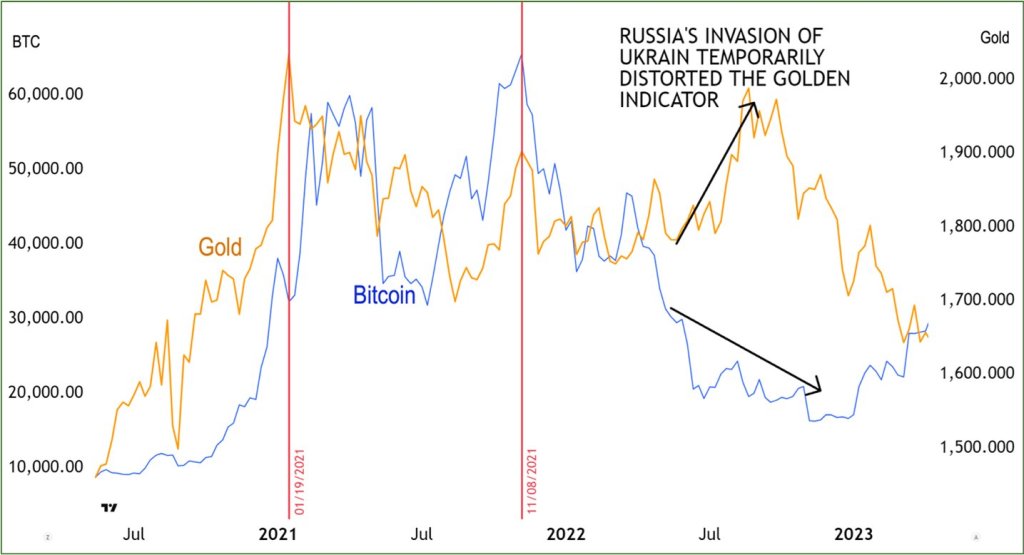

Bitcoin Is Secretly Tracking This Market Signal: Weiss Crypto

A thread posted late on 4 August 2025 by Weiss Crypto analyst Juan Villaverde has ignited debate abo...