Could Crypto Bets Serve as a "Powell Play" Hedge?

US President Donald Trump’s ongoing pressure on Federal Reserve Chair Jerome Powell is once again prompting speculation about the potential consequences of the president dismissing the beleaguered central bank chief.

This action would set a historic precedent in the United States, likely leading to a significant legal battle that would capture the attention of both the political sphere and financial markets, ultimately culminating in a decision from the nation's highest court.

The confrontation between Trump and Powell raises concerns about the potential for his dismissal, which could jeopardize market stability.

Experts caution about potential legal actions, a decline in the dollar's value, and increasing inflationary pressures.

Although there may be an initial wave of concern in the crypto market, a potential for long-term growth exists following interest rate cuts.

While Bitcoin could act as a safeguard, we anticipate significant fluctuations in the immediate aftermath of this situation.

On July 16, reports surfaced that President Trump was expected to take action against Powell, who has been the president's target for his unwillingness to listen to calls for reduced interest rates.

This led to chaos.

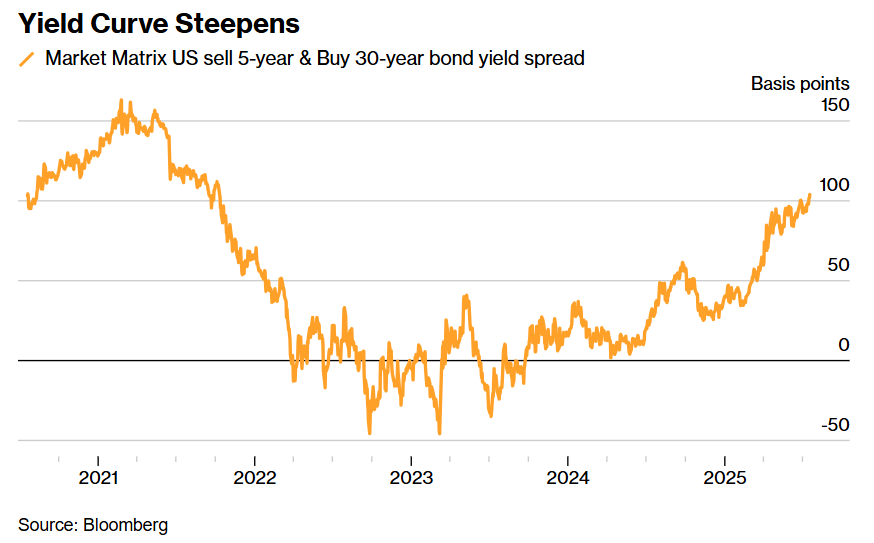

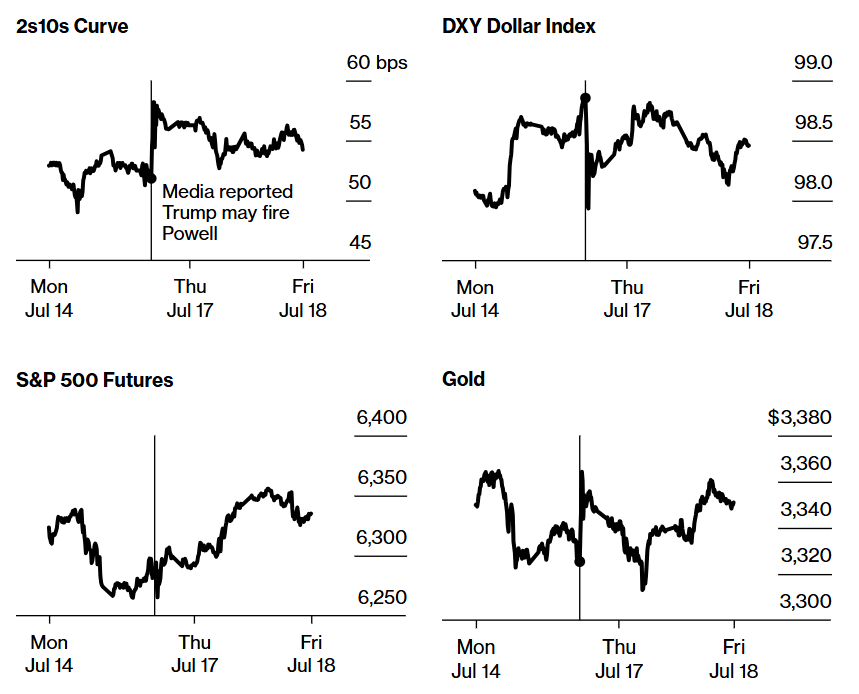

In the brief period of less than an hour following the news that Trump might dismiss Powell, the yields on 30-year US bonds surged by 0.11 percentage points, while the spread between these and five-year notes reached its widest point since 2021.

The dollar declined by over 1% relative to the euro, while the stock market experienced a significant downturn.

Trump shot down the rumors, saying it was "highly unlikely, unless he has to depart" because of "fraud." He also denied that Powell would be removed from his position.

The statement pointed to budget excesses related to the renovations at the Federal Reserve headquarters, which Trump and his supporters have been focusing on as a possible justification to dismiss Powell “for cause.”

Section 10 of the Federal Reserve Act, which regulates the central bank, states that members of the Fed’s Board of Governors, including the chair, may be “removed for cause.”

Wall Street has two hedging strategies against such a move.

One is to shelter in cryptos as a hedge against inflation, and the other is betting on shorter-dated Treasuries.

The recommendation for short-term Treasuries is driven by the hypothesis that a new chair of the Fed may be more inclined to align with Trump's advocacy for reduced interest rates, which could lead to a decline in short-term yields.

More accommodating monetary policy, along with the perceived erosion of the central bank's autonomy, may subsequently heighten inflation worries, leading to an increase in yields on long-term debt.

The events unfolded precisely as described, and even more transpired in the moments following the Powell announcements.

Analysts caution that any attempt to terminate the Fed chief could lead to swift legal action. Legal proceedings may extend over several months. Consequently, extended ambiguity would disrupt all markets. Such instability is generally despised by those in the investment community.

The autonomy of the Fed seems to be facing a significant challenge. The apprehension surrounding political influence on monetary policy unsettles conventional investors.

This apprehension may steer funds toward alternative options. Digital currencies could draw in capital seeking refuge. Nonetheless, it appears that an initial wave of market anxiety is probable.

Recent weeks have seen a surge in criticism directed at the chair of the Federal Reserve, as Trump and his associates capitalize on the rising renovation expenses of the central bank's headquarters in Washington to amplify their scrutiny of Powell.

The Fed chief asserts that the central bank would have reduced interest rates this year were it not for the uncertainties introduced by Trump's tariff war affecting the economic and inflation landscape.

Deutsche Bank forecasts a significant hit to the dollar. The trade-weighted dollar could potentially decline by 3-4% in the following 24 hours.

The dollar has already fallen nearly 10% year-to-date to mark the worst start to a year since the collapse of the Bretton Woods System.

Additional depreciation appears likely.

Concerns regarding the potential politicization of central banks and the escalation of inflation could undermine confidence. A depreciating dollar usually helps enhance Bitcoin's value.

Consequently, stakeholders perceive it as a safeguard against fiat currency fluctuations. Historical trends indicate that Bitcoin performs well when the dollar is weak.

Moreover, discussions within crypto communities on X are filled with a sense of optimism. Forecasts are suggesting that Bitcoin could reach $150,000 if Powell is fired.

There is an expectation for rapid and substantial reductions in rates from a successor aligned with Trump. Decreased rates diminish the expense associated with maintaining non-yielding assets. As a result, Bitcoin and other cryptocurrencies gain a relative appeal.

The removal of Powell poses a threat to the credibility of the Federal Reserve. Market dynamics could indicate a shift towards more accommodative monetary policies in response to political influences. Trump advocates strongly for reductions in interest rates. His tariff policies further contribute to rising inflation. This will lead to an increase in inflation expectations.

This situation could be advantageous for cryptocurrencies. Bitcoin is frequently promoted as the modern equivalent of gold, often referred to as "digital gold," as it serves as a safeguard against inflation. Gold prices have reached unprecedented levels in light of uncertainty surrounding the Federal Reserve.

In a similar vein, there may be an increase in safe-haven interest for cryptocurrencies. Individuals looking to diversify their portfolios may turn towards decentralized options as confidence in conventional systems wanes.

? JUST IN: Jim Cramer says he wants to “own” Bitcoin and Ethereum for his kids, calling it a hedge against the U.S. national debt. pic.twitter.com/vRl96a6cIp

— Crypto Briefing (@Crypto_Briefing) July 23, 2025

Cryptocurrency presents a viable option beyond the influence of central banks.

There may be a significant influx of capital into uncollateralized crypto-primitive assets. However, this has yet to be thoroughly evaluated in the context of significant crises.

The response from the cryptocurrency market is expected to be unpredictable and complex. Early anxiety may lead to widespread market declines. Equities have already declined on mere threats of termination.

Cryptocurrency tends to show initial correlation during periods of risk aversion. Increasing Treasury yields present an additional immediate risk.

Deutsche Bank anticipates a sell-off in Treasuries ranging from 30 to 40 basis points. Increased yields enhance the attractiveness of safer bonds. This may lead to a short-term withdrawal of funds from unpredictable cryptocurrency markets.

Conversely, significant reductions in rates down the line could potentially invigorate the cryptocurrency market.

The enduring appeal of decentralized finance could solidify over time. However, the vulnerabilities of stablecoins and the impact of international regulations present significant challenges.

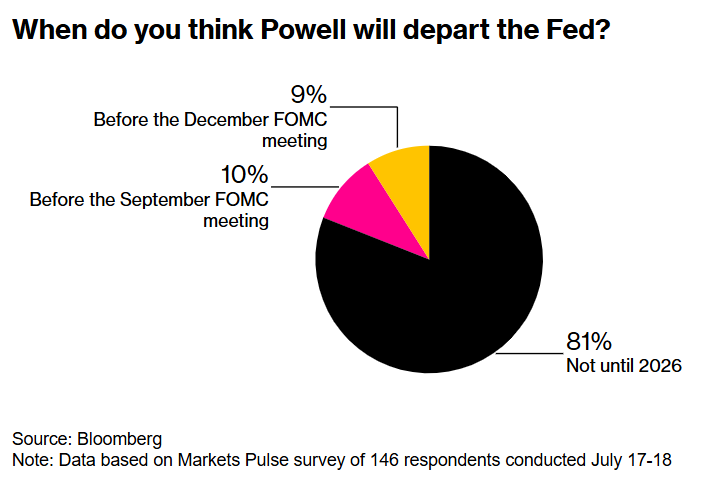

However, the firing of Powell is not the baseline scenario. A Bloomberg survey shows a significant majority expect the Fed chief to serve his term, which ends next year.

Separately, Fed Governor Christopher Waller, a potential candidate for the next Fed chair, suggested on Friday that he might oppose his colleagues' decision to maintain interest rates at their upcoming policy meeting in late July, advocating instead for a rate cut to bolster the labor market.

However, the market consensus is for the Fed to stay on the sidelines next week.

According to the latest Bloomberg Markets Pulse survey, a third of the participants identified Waller as their preferred candidate to succeed Powell, with Treasury Secretary Scott Bessent trailing closely behind.

Elsewhere

Blockcast

Future-Proofing Crypto: Quranium's Quantum Revolution

This week, host Takatoshi Shibayama speaks to Kapil Dhiman, co-founder and CEO of Quranium , a quantum-proof blockchain founded in 2024 that combines AI-native architecture, EVM compatibility and quantum security. They discuss Kapil's journey from a CPA to an entrepreneur in the blockchain space, the significance of quantum computing, and the dual nature of technology – its potential benefits and risks. Kapil emphasized the urgency of preparing for a quantum future, the importance of security in digital assets, and the roadmap for Quranium's innovations in creating a secure environment for cryptocurrency.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Eric van Miltenburg (Ripple), Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Blockhead is a media partner of Coinfest Asia 2025. Get 20% off tickets using the code M20BLOCKHEAD at https://coinfest.asia/tickets .

Corporate Treasury Revolution: Can Bitcoin Hit $200,000?

Could huge monies lining up for Bitcoin's corporate treasury revolution boost the token further?...

Liquidation Cascade Deepens - How We're Waiting for Bottom Signals

Your daily access to the backroom....

BitMine Ethereum Holdings Cross $2 Billion Mark

Company accumulates 566,776 ETH in 16 days, expanding treasury position by 700% beyond initial fundi...