Kazakhstan Considers Bitcoin in National Reserves, Eyes State-Backed Crypto Fund

Notably, Kazakhstan is exploring a significant financial strategy shift by potentially dedicating part of its sovereign reserves, traditionally comprised of foreign currency and gold, to investment vehicles tied to the crypto industry, such as ETFs or shares in blockchain-related companies.

Central Bank Governor Timur Suleimenov has acknowledged that this proposal is currently under evaluation. He described it as part of a broader strategy to diversify and modernize the nation’s long-term investment portfolio.

“We’re studying the possibility, but we must be careful,” Suleimenov said in a public statement. “Digital assets offer high returns, but also high risk.” The move would align Kazakhstan with global financial trends. Institutional investors worldwide are increasingly allocating funds to cryptocurrencies. Suleimenov referenced Norway’s Government Pension Fund, U.S. institutional investors, and sovereign funds in the Middle East as models for Kazakhstan’s evolving investment outlook. Crypto Reserve in Development Beyond potential reserve diversification, Kazakhstan is developing a plan to launch a national crypto reserve. The move could make it one of the first countries globally to formalize a government-backed digital asset fund. According to officials, the fund would initially consist of digital assets confiscated through legal enforcement. Additional funding could come from tax revenues or mandatory contributions from state-involved crypto mining enterprises. Kazakhstan currently ranks among the leading countries in Bitcoin mining. It accounts for around 13% of the global hashrate, thanks to low electricity costs and favorable regulations. Tighter Regulations Signal Institutional Shift Complementing its investment exploration, Kazakhstan is implementing stricter regulations in the crypto space. These include criminal penalties for unlicensed trading and restrictions on unauthorized advertising. All cryptocurrency transactions must now be conducted through licensed exchanges operating within the Astana International Financial Centre (AIFC). The AIFC is a regulated economic zone that promotes fintech innovation. Analysts see this dual-pronged strategy, institutional investment and regulatory tightening, as a signal of Kazakhstan’s intent to emerge as a trusted player in global digital finance. By fostering legal clarity and encouraging state-level participation, the country can create a more secure digital asset environment. This, in turn, could attract both domestic and international investors. If implemented, Kazakhstan’s integration of crypto-related assets into its sovereign reserves would mark a cautious but pivotal step in state-level crypto adoption, offering a new blueprint for establishing digital asset legitimacy.

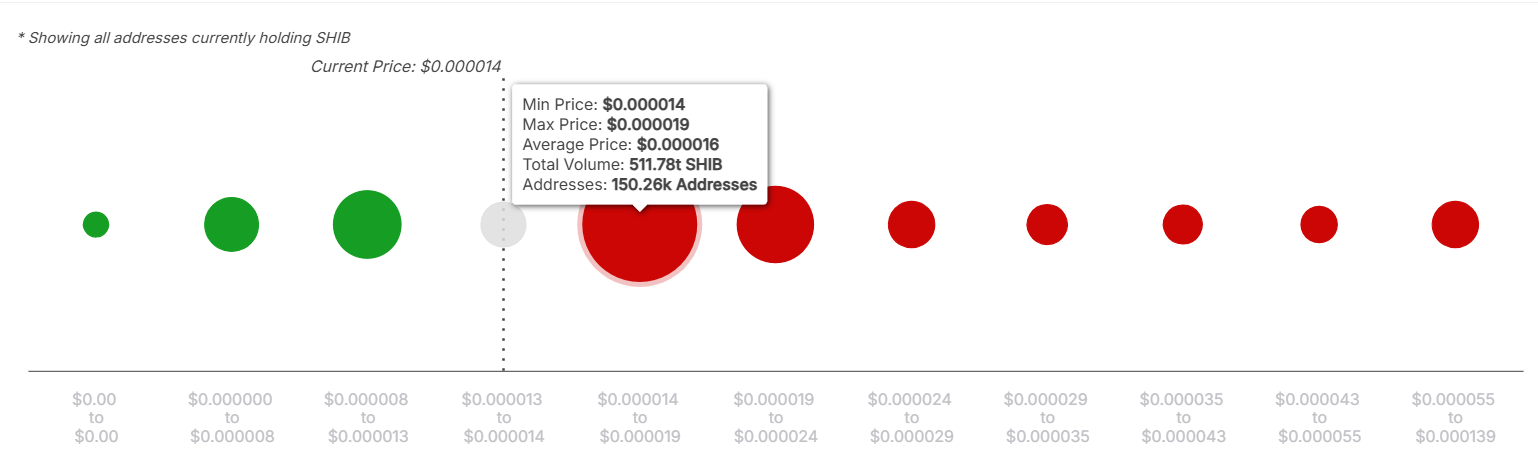

Onchain Data Shows Levels Shiba Inu Must Breach Before It Can Reclaim $0.000035

Amid the ongoing recovery effort, Shiba Inu has multiple resistance roadblocks to conquer before rea...

Crypto Exec Says You Can Have 1,000,000 XRP and Still End Up Broke

Jake Claver, Managing Director at Digital Ascension Group, recently reminded the XRP community that ...

Cardano and XRP Ecosystems Partnership Looms as Tokeo Wallet Plans XRPL Integration

A partnership between Cardano and the XRP ecosystem has gained momentum amid prospects of a Tokeo Wa...