DWF Ventures Analyzes USDT’s Prospects of Dominating Competitive Stablecoin Market

Dubai, UAE, July 12th, 2025, Chainwire

DWF Ventures, the venture arm of web3 investor and market maker DWF Labs, has released a comprehensive report exploring the future of stablecoins, with a spotlight on Tether’s USDT and scaling solutions like Plasma and Stable. The analysis delves into the current state of stablecoins and how new purpose-built chains are poised to enhance USDT’s global adoption by addressing compliance and scalability issues.

In its stablecoin analysis, delivered in the form of an X thread, DWF Ventures examines the evolution of stablecoins, from synthetic dollars to digital payment solutions powering over $27 trillion in transfer volume, surpassing giants like Visa and Mastercard. It highlights how stablecoins now support use cases such as inflation hedging, global payroll, remittances, and consumer fintech. The report assesses the US Treasury Secretary’s expectation of a $2 trillion stablecoin market by 2028, alongside recent milestones like Circle’s IPO and the GENIUS Act.

However, DWF Ventures identifies key inefficiencies in the current stablecoin ecosystem, including liquidity fragmentation across chains, lack of transparency, complex fiat ramps, and vulnerability to regulatory shifts. Issuers and adopters face chain dependency risks, volatile fees, and optimization gaps, particularly as over 80% of transactions occur on Tron and Ethereum.

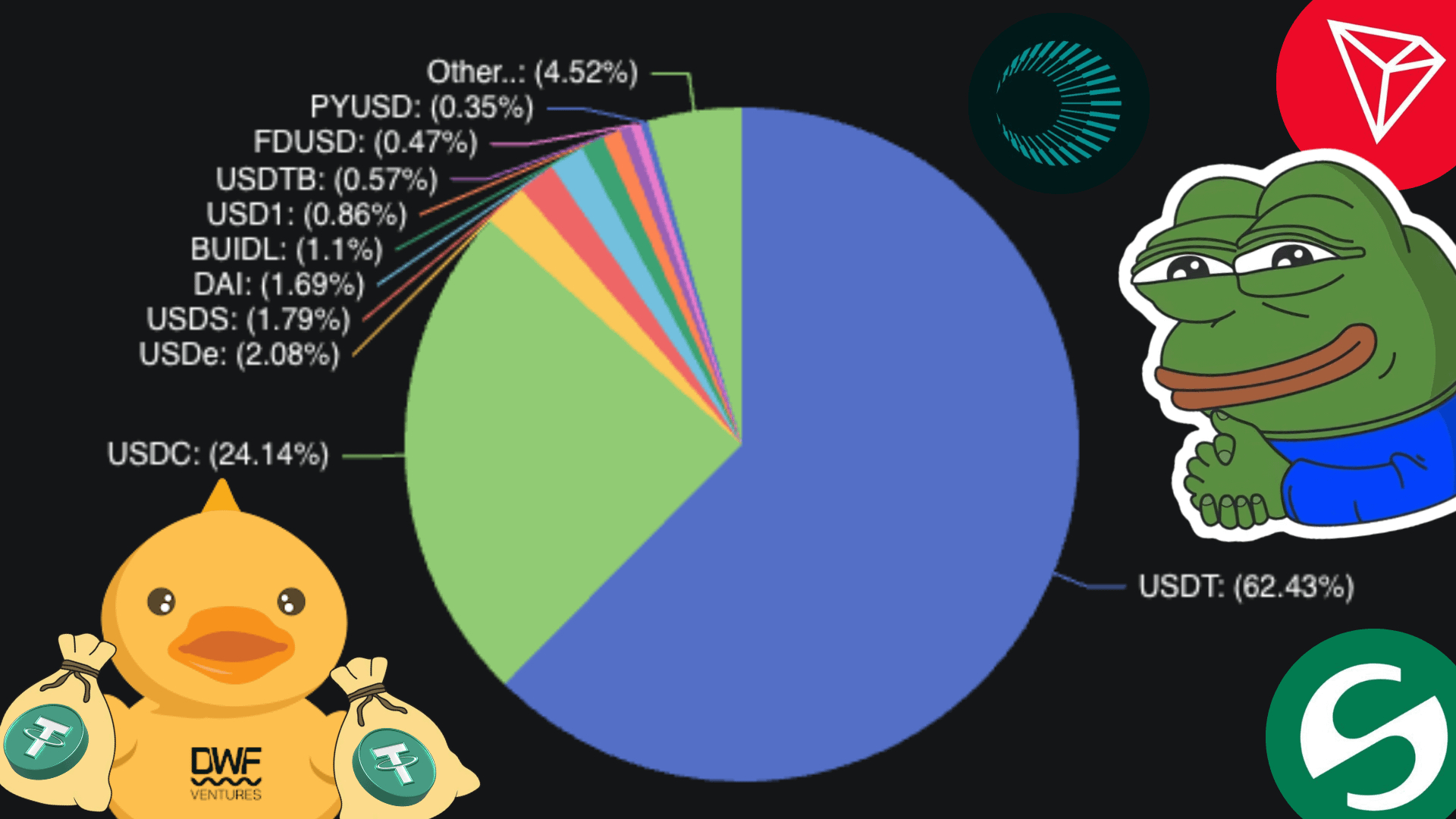

Tether dominates with a 62% market share and commensurate revenue, with USDT and Circle’s USDC accounting for 83% of transactions. This dominance has spurred new projects like Stable and Plasma, both backed by Tether, to optimize USDT for broader use cases such as payments, remittances, and enterprise DeFi.

Stable is an EVM-compatible Layer 1 designed exclusively for stablecoins, featuring zero gas fees on USDT transfers and native USDT gas payments, DWF Ventures notes, making it the first standalone L1 to enable this. It unlocks low-cost scalability through features like bridging via LayerZero, native liquidity on Stable L1, built-in institutional compliance tools, off-chain sequencing, and a private mempool for enterprises.

Plasma, an EVM-compatible Bitcoin sidechain focused on stablecoins, has already hit a $1 billion deposit cap amid buzz around its upcoming XPL public sale. It emphasizes enabling scalable onchain merchant payments, remittances, commodity trading, and yields on stablecoins and Bitcoin. Key features include gas fees paid in whitelisted tokens with zero fees for USDT transfers, optional privacy via ZK or mixer protocols, and performance of up to 2K TPS with low latency.

The report compares these solutions against Tron, highlighting shared traits such as the ability for USDT to serve as a native gas token as well as the availability of protocol-level compliance, but notes distinctions in network types, consensus mechanisms, and privacy features. While Tron excels in cross-chain bridging, high DeFi activity, and community governance, Stable prioritizes enterprise tools, and Plasma offers optional privacy and Bitcoin integration.

DWF Ventures warns of ongoing challenges, including regulatory uncertainties and the need for better infrastructure to scale stablecoins into a foundational financial system. Yet it remains bullish, viewing Plasma and Stable not as replacements for USDT but as upgrades for faster and compliant global adoption.

The analysis concludes: “Stablecoins as a whole aren’t just growing, they are forming and becoming the foundation for a new financial system.” DWF Ventures anticipates continued stablecoin growth and innovation and invites builders to connect for potential investments.

The full DWF Ventures stablecoin analysis can be read here .

About DWF Labs

DWF Labs is the new generation Web3 investor and market maker, one of the world’s largest high-frequency cryptocurrency trading entities, which trades spot and derivatives markets on over 60 top exchanges.

Learn more: https://www.dwf-labs.com/

Contact

VP of Communications

Lynn Chia

DWF Labs

[email protected]

BlockFi Settles DOJ in $35M Asset Dispute as Bankruptcy Winds Down

BlockFi reportedly settles $35M asset dispute with DOJ, this marks a key milestone as its bankruptcy...

Broken Bound and Conflux Network Forge Path for Regulated GameFi in Asia

The collaboration focuses on redefining the Web3 gaming sector across Asia with regulation-friendly,...

Discover Top Assets: TAO, NEAR, RENDER, FET, & WLD Take Lead as Grayscale’s Most-Traded AI Crypto Assets

The data listed top-performing AI crypto assets on Grayscale, indicating these tokens continue to ga...