Bitcoin Holds Above $108,800 as Funding Rate Trends Point to Bullish Continuation

- Bitcoin holds above $108,800 with trading volume surging 32% in 24 hours.

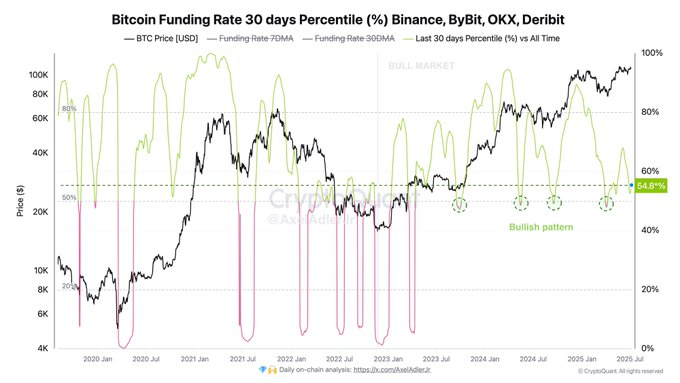

- Funding rate percentile at 54.89% signals possible bullish continuation.

- Historical drops near 50% in funding rate often preceded Bitcoin price rallies.

Bitcoin maintained its position above $108,800 on July 7, continuing a short-term uptrend that began the previous day. The price action followed a surge in trading volume and coincided with a historically consistent funding rate signal that has previously marked local market bottoms.

As of 10:00 AM UTC on July 7, Bitcoin was priced at $108,874.69, reflecting a 0.76% increase over the past 24 hours. According to CoinMarketCap data, 24-hour trading volume jumped 32.2% to $39.63 billion, while market capitalization reached $2.16 trillion. The fully diluted valuation stood at $2.28 trillion. Additionally, the volume-to-market-cap ratio rose to 1.83%, indicating strong market engagement.

The price climb began around midday on July 6, with Bitcoin moving up from $108,060. It registered multiple intraday highs through the evening and touched $109,200 before encountering minor resistance. Throughout the early hours of July 7, price movement fluctuated between $108,600 and $109,200, maintaining support above $108,700. The current circulating supply of Bitcoin is 19.88 million BTC , representing over 94.7% of the total maximum supply of 21 million BTC.

Funding Rate Percentile Signals Trend Continuation

New chart data tracking the 30-day percentage funding rate across Binance, Bybit, OKX, and Deribit shows that Bitcoin’s upward price movement has coincided with recurring dips in speculative positioning. The percentile currently stands at 54.89%, a neutral-to-slightly bullish range, following a rally from a local bottom recorded in April 2025.

Source: X

Funding rate historical data has shown that negative shifts in the 30-day percentile to lower levels, and frequently to the 50th percentile level, have consistently been followed by bull runs. These were held in September 2023, May 2024, September 2024, and April 2025. In both cases, declines in funding rates were preceded by increases in the price of Bitcoin.

The graph also overlays the 7 and 30-day moving average funding rate. According to statistics, when the percentile was reduced to less than 40 percent in an appreciating environment, the information reversed in favor. This new tendency is also in line with the past behavior.

Embedded Compliance Fuels $5.6 Billion Tokenized Treasury Boom

Tokenized U.S. Treasuries have surged past $5.6 billion by April 2025, driven by BlackRock’s BUIDL f...

DeepLink and Roam Unite to Build Borderless Cloud Access and Gaming

DeepLink and Roam have announced a strategic partnership to deliver borderless cloud infrastructure ...

Broken Bound Integrates with VERSE Boost DeFi Memeconomy

VERSE and Broken Bound unite to blend Web3 gaming with cross-chain decentralized finance (DeFi) to f...