Global M2 Can’t Predict Bitcoin Price, Says Quant Analyst

Sina—co-founder of the hedge fund 21st Capital—publicly dismantled a popular Bitcoin price model promoted by Real Vision CEO Raoul Pal, calling it a textbook case of data illiteracy and overfitting.

The model in question draws a close correlation between Bitcoin and Global M2 —a measure of global money supply—by shifting M2 data forward by a set number of weeks, typically 10 to 12, to supposedly “predict” Bitcoin’s future price moves. Raoul Pal has used this chart to argue that macro liquidity conditions drive crypto cycles, and that the current market behavior can be forecast using monetary expansion.

Expert Torches M2-Bitcoin Correlation

But Sina, a trained data scientist who teaches data analytics at the undergraduate and graduate level, says this model collapses under scrutiny. “This is a terrible failure of not understanding overfitting,” he said in a June 24 video posted to X. “What I’m seeing doesn’t even pass the first month of a first-year data analytics course.”

Sina points out that the apparent correlation between Bitcoin and Global M2 only exists because the data has been “tortured” to fit historical patterns. “If I’m allowed to play with the data and arbitrarily move things around, I can definitely find great matches between pockets of data,” he said, warning that this flexibility is exactly what allows analysts to create the illusion of predictive accuracy.

The primary issue, he explained, is that the Global M2 data itself is inherently flawed . It’s compiled by multiplying various central banks’ M2 figures by exchange rates—mixing fast-reporting economies like the US with countries that have data delays of weeks or even months. This creates a misleading impression of daily fluctuations in global liquidity. “It seems to be moving on a daily basis, but it’s actually mixing frequent and infrequent updates,” Sina said. “It’s not a true signal.”

More importantly, Sina argues that the model fails the moment one zooms out from selective chart slices. While Raoul Pal and others have showcased examples of tightly aligned tops and bottoms between Bitcoin and Global M2, Sina demonstrated how minor tweaks in lead time or scale can yield dramatically different outcomes. “Let’s try a lead of 80 days. That doesn’t look good. What about 108? Ah, now the tops align—so let’s zoom in again and pretend it works,” he said sarcastically. “This is not modeling. This is playing.”

He highlighted how each adjustment to the model—shifting from a 12-week lead to 10 weeks, to 108 days—exposes its lack of systematic foundation. “If you don’t have a proper model, you fail to predict the future,” Sina said. “This is classic overfitting. You force the data to match historical behavior, but you lose any generalizability.”

To illustrate the concept, Sina compared it to fitting a curve through a noisy sine wave. A well-structured model captures the core pattern and ignores noise. An overfit model, by contrast, attempts to match every small fluctuation—resulting in poor predictive performance when new data arrives. “Overfitting looks better, but it models noise. And noise doesn’t repeat,” he said.

Sina also questioned whether Bitcoin might actually lead liquidity, not follow it. “If you look at the last cycle, Bitcoin topped first. Liquidity topped 145 days later,” he said. This reverses the causality implied by the Global M2 model and calls into question its entire premise as a forward-looking tool.

His conclusion was blunt: “You have to be very careful with overfitting. It looks matching, but it’s forcibly fit on historical data. You have no idea about the predictive accuracy of this thing.”

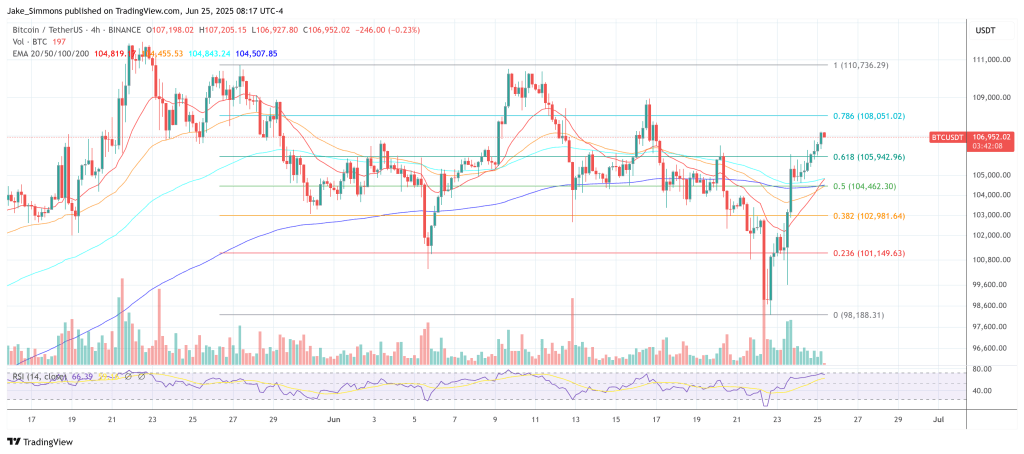

At press time, Bitcoin traded at $106,952.

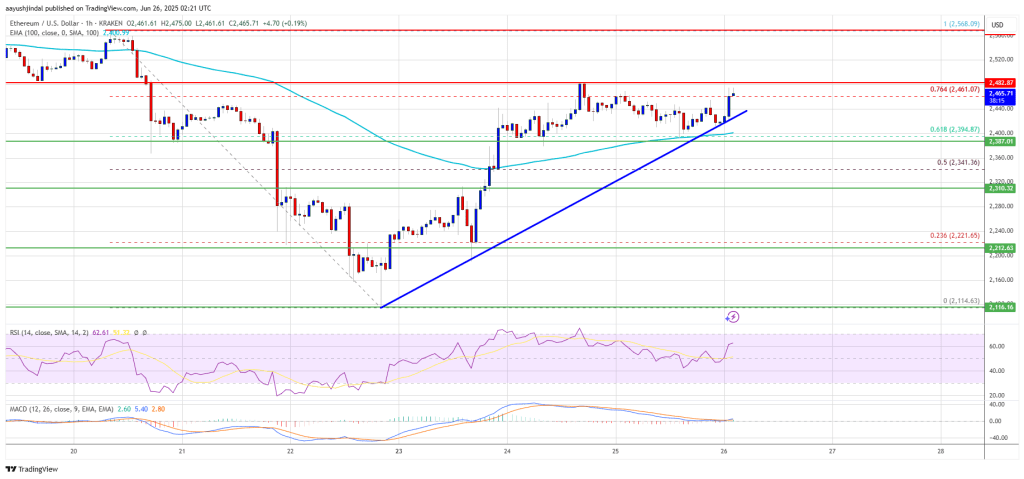

Ethereum Price Signals Strength — Bullish Pop May Be Just Ahead

Ethereum price started a fresh increase above the $2,350 zone. ETH is now showing positive signs and...

Ethereum Gears Up For Breakout Above $2,800 – Bullish Momentum Builds

Ethereum has experienced a strong comeback after weeks of uncertainty and bearish momentum. Followin...

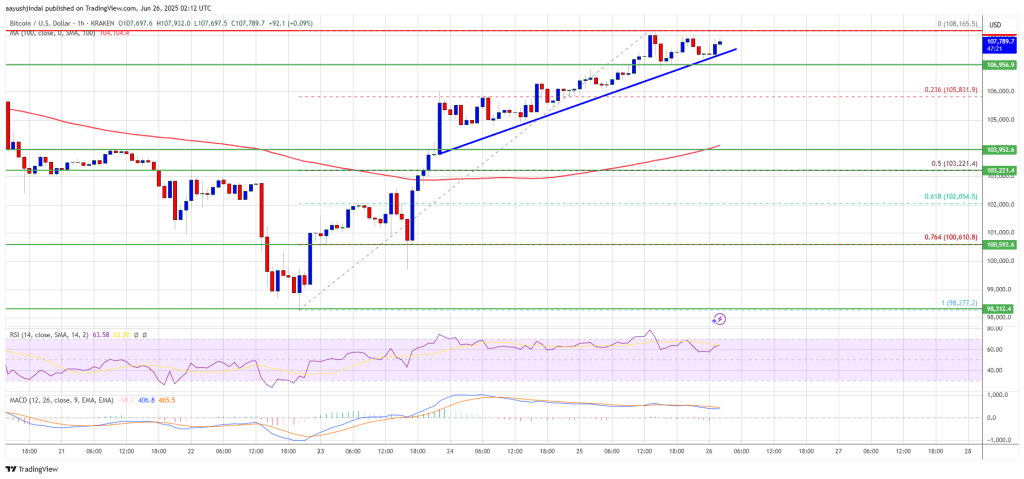

Bitcoin Price Back In The Green — Momentum Builds for More Gains

Bitcoin price started a fresh increase above the $105,500 zone. BTC is now consolidating and might a...