Bitcoin’s Bull Market Shows Resilience with Minor Corrections and Strong Recovery Patterns

- Bitcoin’s price steady with two major 30%+ corrections and quick recoveries since 2022.

- Current minor drawdown near -4.7% signals stable consolidation around $100K-$106K range.

- Market cap rises to $2.12T amid lower trading volume, showing reduced liquidity.

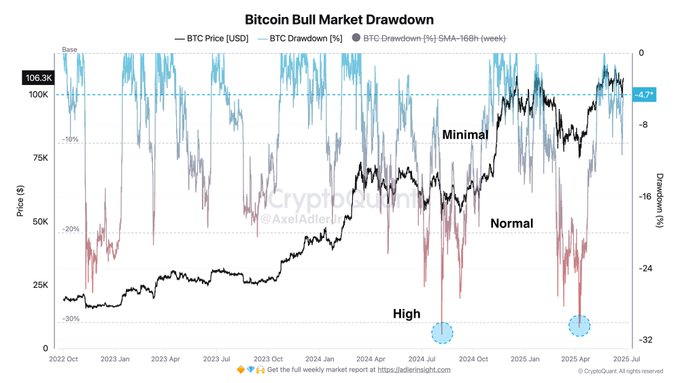

Bitcoin’s price has grown steadily since the start of the bull cycle in November 2022, with only two major corrections surpassing 30% occurring in August 2024 and April 2025. Each of these major pullbacks was followed by rapid price recoveries, confirming the continuation of the upward trend. Outside these events, Bitcoin’s price fluctuations remained within the typical 10-20% correction range, serving as standard market adjustments without disrupting the overall bullish momentum.

During the time of writing, Bitcoin was consolidating in the $100,000 to $106,000 range, showing a calm market phase supported by a weekly simple moving average (SMA) drawdown near -7%, and a current drawdown of approximately -4.7%.

These levels point to a minor correction relative to previous steep drops. Historical data from the ongoing bull market cycle shows a consistent sequence: deep drawdown phases followed by accumulation periods and subsequent upward impulses. The decreasing amplitude of price pullbacks signals increasing market stability.

The chart titled “Bitcoin Bull Market Drawdown” tracks Bitcoin price movements alongside percentage drawdowns from October 2022 through mid-2025. It classifies drawdowns into minimal (above -10%), normal (-10% to -20%), and high (exceeding -20%) levels. Two high drawdown events, occurring around July 2024 and April 2025, are noted for their near 30% price drops, yet these corrections did not interrupt the broader bullish trajectory.

Current Market Metrics and Trading Activity

At the time of reporting, Bitcoin was trading at $106,942.95, reflecting a 1.42% increase over the last 24 hours. The market capitalization reached $2.12 trillion, a 1.3% ris, indicating overall growth in valuation.

Yet the 24-hour trading volume has dropped by 32.43 percent to 45.55 billion due to lower liquidity or trading despite good price rise. The volume to market cap is 2.14%, which indicates how engaged the market is in terms of total valuation.

Using the total number of coins 21 million as the fully diluted value (FDV), the approximated value will be a total of 2.24 trillion dollars. Right now it is estimated that 19.88 million BTC are circulating, so most of the total supply is mined and has been actively traded or held.

Sign Up Today – 10 USDC Bonus + Daily 0.5 USDC Rewards!

Sign up at CPSPAI for a $10 bonus + daily $0.5 rewards. No tech skills needed—start earning passivel...

Alchemy Pay and Xterio Partner to Enable NFT Purchases with Fiat and Cards

Alchemy Pay and Xterio unite to enable global NFT purchases using fiat and cards by easing Web3 gami...

N1Chain Teams Up With OKX: $100K Raffle and 24-Hour Broadcast Announced

N1Chain has just revealed a business alliance with giant crypto exchange OKX in a big move that is a...

Adler Jr (@AxelAdlerJr)

Adler Jr (@AxelAdlerJr)