Bitcoin Yearly Trend Suggests Cycle Top Near $205,000 By Year-End, Analyst Says

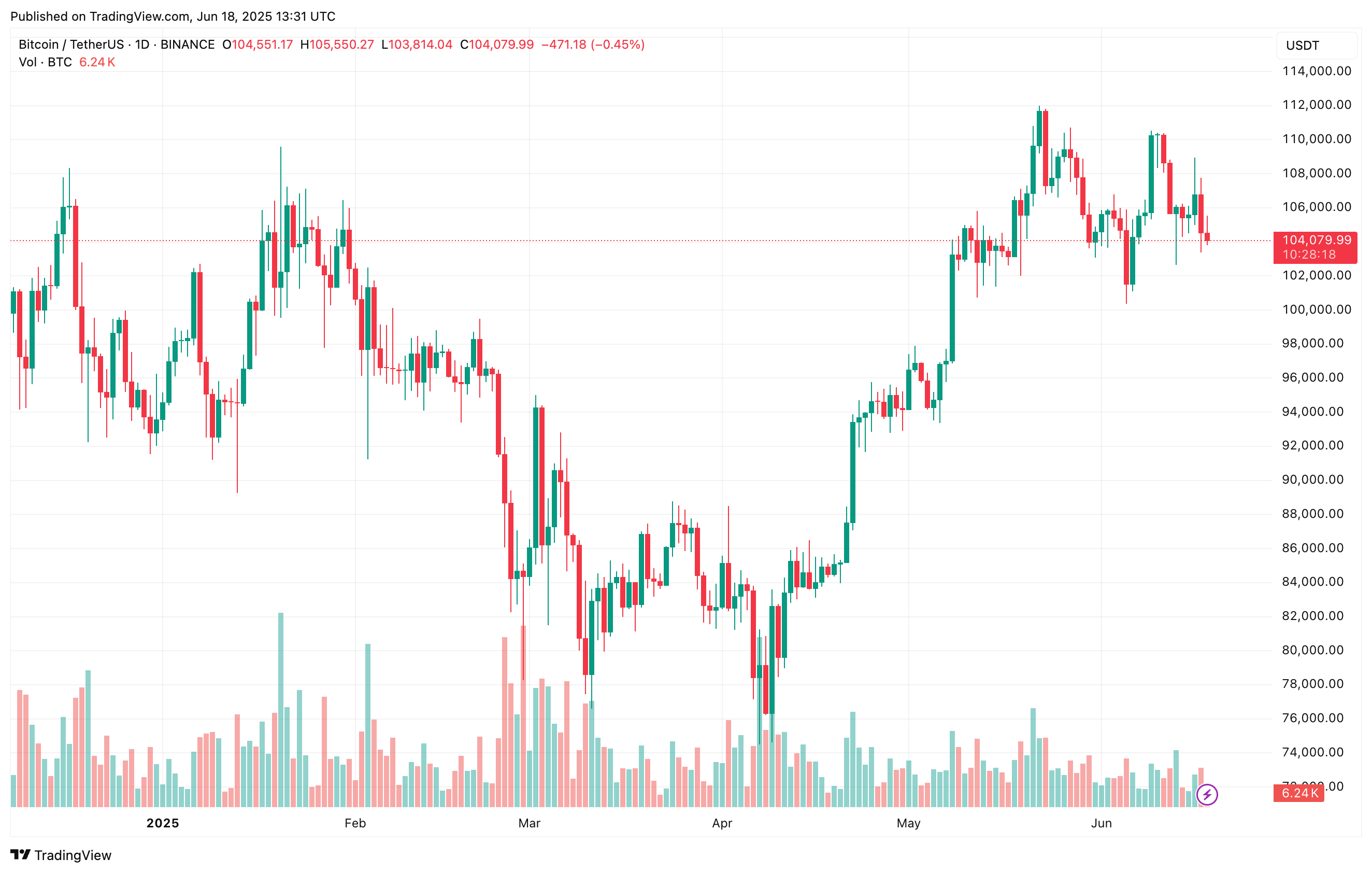

Bitcoin (BTC) has seen a moderate price correction since June 11, falling from around $111,000 to just above $104,000 at the time of writing. While rising geopolitical tensions in the Middle East may be weighing on the asset, several analysts maintain that BTC’s long-term bullish trajectory remains intact.

Bitcoin To Top At $205,000?

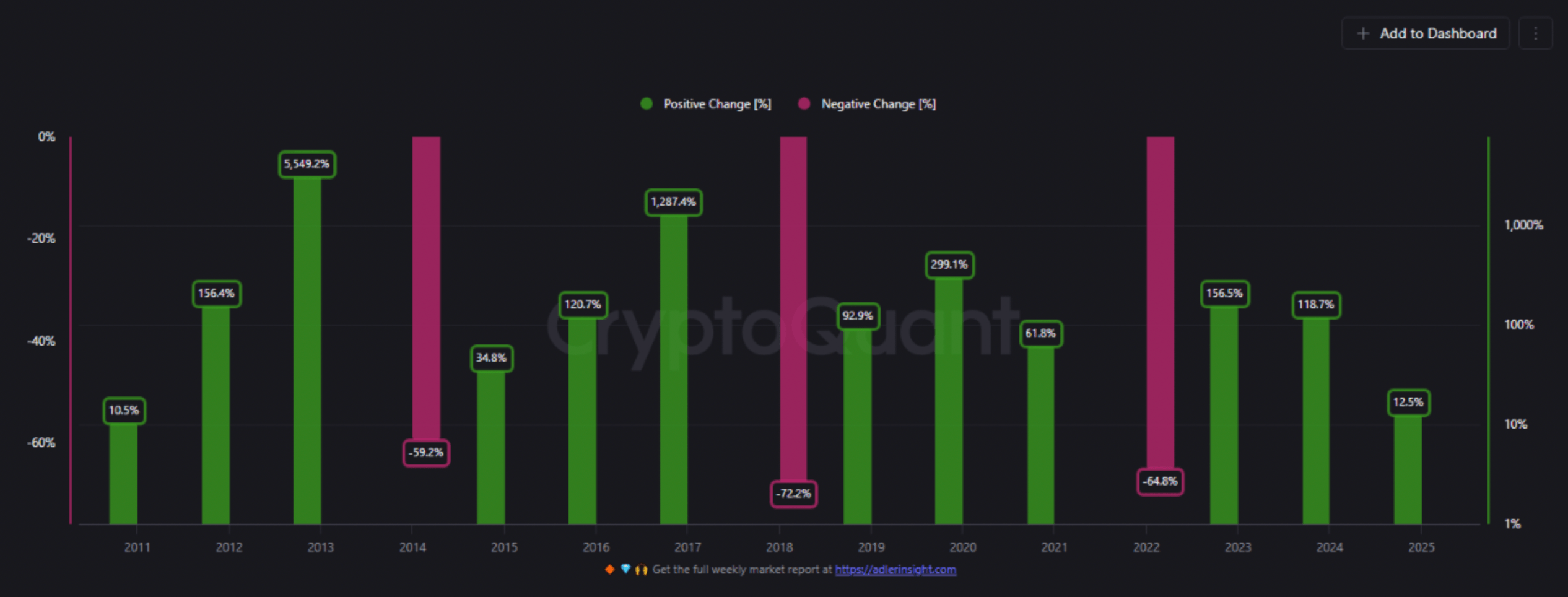

In a recent CryptoQuant Quicktake post, contributor Carmelo Aleman pointed to the Bitcoin Yearly Percentage Trend as a signal of strong potential growth in BTC’s price through the rest of 2025.

For the uninitiated, the Bitcoin Yearly Percentage Trend tracks BTC’s annual price performance since 2011, revealing a recurring pattern of three bullish years followed by one year of consolidation. This trend aligns closely with Bitcoin’s four-year halving cycle, helping investors identify long-term market phases beyond short-term volatility.

Aleman shared the following chart to support his outlook for 2025. If BTC maintains the growth pace typically seen in the third year of this cycle, it could climb 120% in 2025.

Such a surge would take BTC from $93,226 at the beginning of the year to as high as $205,097 – potentially marking the cycle top for this year. If realized, this would make 2025 the third consecutive year of gains and complete another full bullish cycle.

This scenario suggests that BTC is currently in the final phase of its ongoing cycle, giving investors limited time to adjust their strategies to align with the market’s growth trajectory. Supporting this outlook, other cyclical metrics – such as Realized Cap – continue to post new all-time highs in 2025. Aleman concluded:

The Bitcoin Yearly Percentage Trend is a tool that allows us to filter out daily market noise and reconnect with Bitcoin’s true cyclical nature. It reminds us that beyond micro metrics and short-term candles, Bitcoin adheres to a structural rhythm that repeats with striking consistency: three years of expansion followed by one of compression.

On-Chain Indicators Suggest More Upside

Beyond the Yearly Percentage Trend, several on-chain metrics continue to support a bullish case for BTC. Notably, both whale and retail BTC inflows to Binance have dropped to cycle-lows – often a sign that investors are holding in anticipation of further gains.

Whales also appear to be accumulating ahead of a potential breakout. According to CryptoQuant analyst Amr Taha, Bitcoin whales withdrew 4,500 BTC from Binance on June 16 – a move historically associated with price rallies.

Still, caution remains warranted. On-chain data indicates that short-term holders have been selling into the recent dip, which could temporarily suppress price momentum. At press time, BTC trades at $104,079, down 1.6% over the past 24 hours.

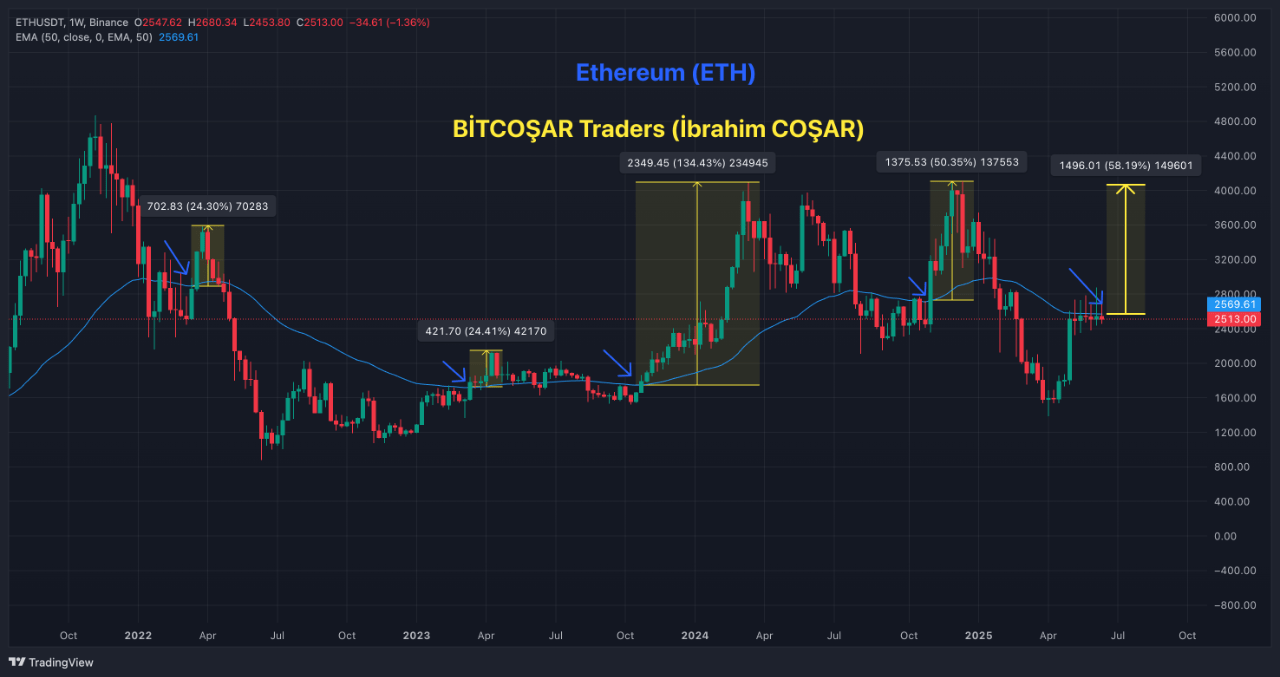

Ethereum Stalls at $2,500, But Is a $4,000 Breakout Closer Than You Think?

Ethereum has struggled to maintain upward momentum following a brief rally that pushed its price abo...

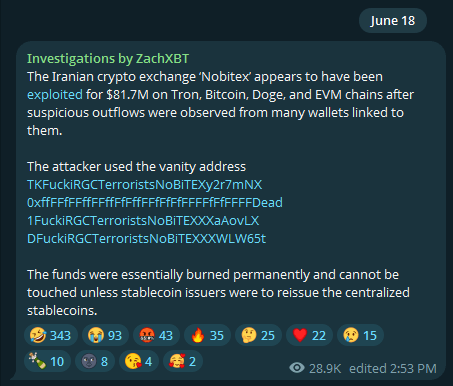

Iran’s Top Crypto Hub Loses $82 Million To Hackers With Israeli Links—Details

An onchain investigator has flagged a major breach at Iran-based Nobitex, where hackers made off wit...

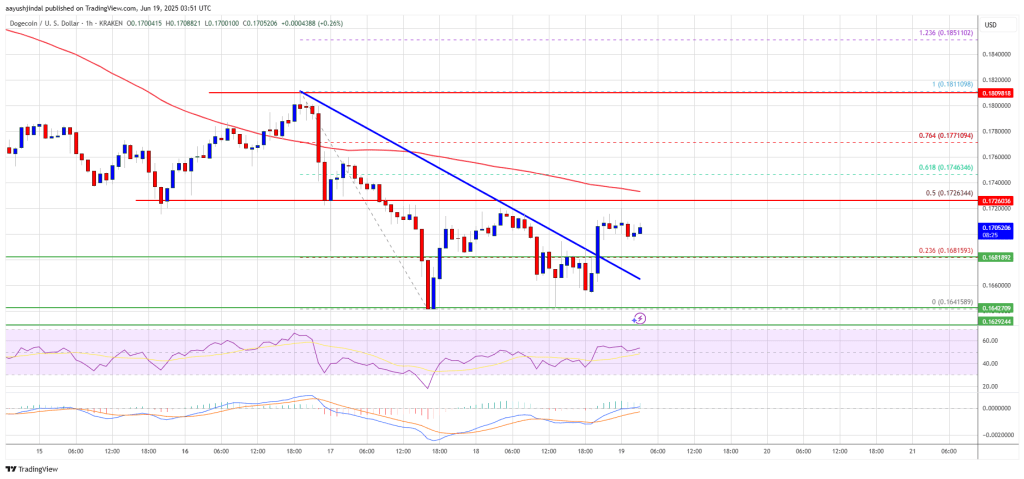

Dogecoin (DOGE) Struggles to Climb — Upside Moves Likely to Face Strong Resistance

Dogecoin started a fresh decline from the $0.1820 zone against the US Dollar. DOGE is now consolidat...