Ethereum Eyes $2,870 After Resistance Break, But Rejection Risks Remain

- Ethereum tests key $2,770 resistance after breaking above $2,690.

- Rejection near $2,740 signals ongoing consolidation and seller pressure.

- Support at $2,690 may hold, but $2,470–$2,380 downside risk remains.

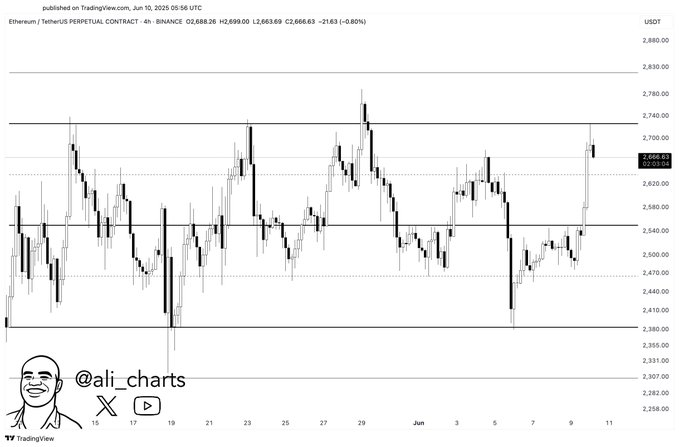

Ethereum’s price movement on June 10 signaled a possible shift in market structure after breaking a key resistance zone. The digital asset surged to $2,755, overcoming the $2,690 barrier before facing strong seller activity just below the $2,770 level. Data from Binance’s 4-hour perpetual contract chart indicates this level remains a critical hurdle.

On June 9, Ethereum began an upward push from the $2,490–$2,610 zone, gaining 2.94% within the day. The breakout came after a higher low formation near $2,410 on June 7. This technical pattern marked the end of a consolidation phase that lasted through late May and early June.

As of early June 10,

ETH

climbed above the $2,690 resistance and reached $2,755. However, the momentum slowed as the price encountered fresh resistance around $2,770. According to charts reviewed by analyst @ali\_charts, further gains could follow if Ethereum manages to close firmly above this zone. In that case, upside targets include $2,870, $2,960, and potentially $3,160.

Resistance Zone Triggers Sell-Off

Despite the breakout attempt, Ethereum’s rally stalled in the early hours of June 10. After touching $2,699, ETH reversed sharply and dropped to $2,666.63, marking a 0.80% decline in the most recent 4-hour candle.

Since late May, the $2,700–$2,740 zone has consistently acted as a resistance band. Multiple rejection events within this range highlight continued selling pressure and overhead supply. The recent pullback highlights the need for a decisive close above $2,740 before bulls can regain control.

Market Consolidation Still in Play

Ethereum remains in a defined horizontal channel, fluctuating between the $2,470 support level and the $2,740 resistance area. Analysts are watching for confirmation of a sustained breakout, which would signal the end of this trading range.

If the price does go down, however, the support at $2,690 may keep it from going any further. A drop lower than $2,580 could occur unless the price stays above $2,640. If the downward trend continues, Bitcoin can be traded at $2,380.

As ETH seeks to retain a neutral-to-bullish design, traders are watching these levels. The upcoming sessions could likely determine whether Ethereum continues its march higher or consolidates further.

How IP Rights, Original Artwork, and Genuine Effort Fuel the Beloved $ZEUS Token

$ZEUS stands out with full IP rights, original art, and deep meme roots—offering authenticity in a m...

Human Passport Takes Aim at Sybil Attacks on Base with New On-Chain Detection Suite

Human Passport launches on-chain, ML-powered Sybil detection and cross-chain scoring for Base, verif...

Cwallet Joins Forces with DeXRP to Transform $XRP Trading Experience

Cwallet partners with DeXRP to modify $XRP trading by offering faster settlements, deeper liquidity,...