Crypto Suffers $1 Billion Flush As Musk-Trump Feud Shakes Bitcoin

Data shows the cryptocurrency sector has seen a large amount of liquidations following the volatility that Bitcoin and others have gone through in the past day.

Bitcoin Has Seen A Rollercoaster Over The Last 24 Hours

The past day has been a wild time for Bitcoin and the cryptocurrency market as a whole as prices have displayed some notable volatility. BTC, especially, has gone through quite the rollercoaster, with its price seeing swings in both the up and down direction.

Below is a chart that shows how the recent price action has looked for the number one digital asset.

As is visible in the graph, the Bitcoin price first went down to a low of $100,400 from a high around $105,800 and then witnessed a recovery run back to $104,100.

The coin is still overall down during the past day, but its loss stands at less than 2%. The other cryptocurrencies haven’t been so lucky, as their prices haven’t quite retraced to the same degree. Ethereum is still down almost 6% and Dogecoin about 7%.

The volatile storm in the sector has come following a public feud between US President Donald Trump and Tesla founder Elon Musk. The spat began when the former said in an Oval Office meeting that he was ‘disappointed’ in the latter over his criticism of the One Big Beautiful Bill Act. Musk had previously called the bill a ‘ disgusting abomination .’

The two let sparks fly on social media, with the SpaceX founder even accusing the President of being in the Epstein files. “That is the real reason they have not been made public,” said Musk in an X post .

Crypto Liquidations Have Neared A Billion

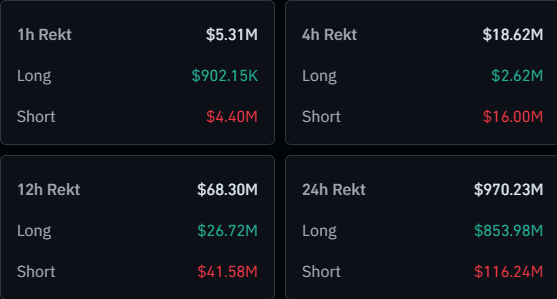

With all the volatility that has gripped Bitcoin and company during the past day, it’s only to be expected that the derivatives market would feel the impact. According to data from CoinGlass , a mass amount of liquidations have piled up on the various centralized exchanges.

“ Liquidation ” here naturally refers to the forceful closure that any open contract has to go through if it amasses losses of a certain percentage.

As displayed in the table, the cryptocurrency market has seen liquidations amounting to a whopping $970 million over the last 24 hours. Out of these, a staggering $854 million, representing 88% of the total, came from the long investors alone. This is naturally down to the fact that prices as a whole have gone down during this window.

Like usual, Bitcoin and Ethereum have led the sector in liquidations, contributing $346 million and $286 million, respectively.

A mass liquidation event is popularly known as a ‘ squeeze .’ Considering that the longs have made up for an overwhelming majority of the latest event, it could be termed a long squeeze .

Bitcoin Golden Cross Pattern Says The Crash To $100,000 Is Normal – What To Expect Next

Bitcoin (BTC) is showing signs of repeating a historic Golden Cross pattern that led to a long-term ...

Elon Musk ‘Will Do Anything’ To Make XRP King, Tech Mogul Says

According to social media buzz, the growing clash between Elon Musk and US President Donald Trump ha...

Ethereum Holds Key Range Support After Pullback – Bulls Eye $3,000 Level

Ethereum has faced a sharp pullback, dropping over 10% in the last 24 hours as global tensions and m...