$500M Bet On Solana: Education Platform Aims To Supercharge Its Treasury

According to reports, Classover Holdings Inc. (NASDAQ: KIDZ) has taken a bold turn. It just signed a deal with Solana Growth Ventures LLC that could bring up to $500 million in senior secured convertible notes.

The deal kicks off with an $11 million investment once all conditions are met. What stands out is the plan to use as much as 80% of net proceeds to buy SOL tokens.

Classover’s Big Crypto Bet

Classover is aiming to build a Solana-based treasury reserve . That means most of its new money will end up in SOL tokens. Even though crypto is known for its ups and downs, the company seems set on this path. It had a 0.02 liquidity ratio before this deal, which shows how tight its cash flow was.

Now, by putting money into SOL, Classover is hoping to steady things out. Based on reports, this move is part of a broader strategy to shift its financial focus toward blockchain assets.

BREAKING

CLASSOVER HOLDINGS SECURES $500M FOR SOLANA TREASURY STRATEGY

PLANS TO ALLOCATE UP TO 80% TO BUY $SOL . pic.twitter.com/mZZAnogzIi

— DustyBC Crypto (@TheDustyBC) June 3, 2025

Convertible Notes And Share Impact

The notes can be turned into Class B common stock. They’re set to convert at twice the closing share price before the deal closes. That gives early investors a chance for upside if the stock moves higher. It also cuts down on dilution risks for the current owners, at least for now.

Chardan is the only placement agent and financial advisor on the deal . The new financing follows a $400 million equity raise that pushed their potential capital access to $900 million. Back-to-back moves like these point to a longer-term plan to overhaul Classover’s treasury setup with Solana at its center.

Struggles In Education Business

Struggles In Education Business

Classover launched in 2020, offering live online classes for K-12 students around the world. They even added AI tools to their platform. But revenues dropped by almost 100% year-over-year. That fall is a red flag for any company.

With a market cap of about $60 million, Classover is in a spot where every dollar counts. Reports say the latest SEC filings show changes to executive pay. It looks like they want to keep their leadership team in place while they work through these money problems. Still, it’s hard to ignore those steep revenue losses and the worry around cash on hand.

Solana’s Price Movements

Solana’s Price Movements

Solana itself has been under pressure lately. It tried to get back above $180 but failed. That led to a pullback in line with a wider market correction. Right now, SOL is trading around $162. That’s about a 6.2% rise in the last 24 hours.

Its total market cap sits at $84.7 billion, and trading volume is around $3.70 billion. If demand doesn’t pick up soon, SOL could slip further before finding strong support. For Classover, any big drop in SOL’s price could hurt its new treasury plan.

Featured image from Unsplash, chart from TradingView

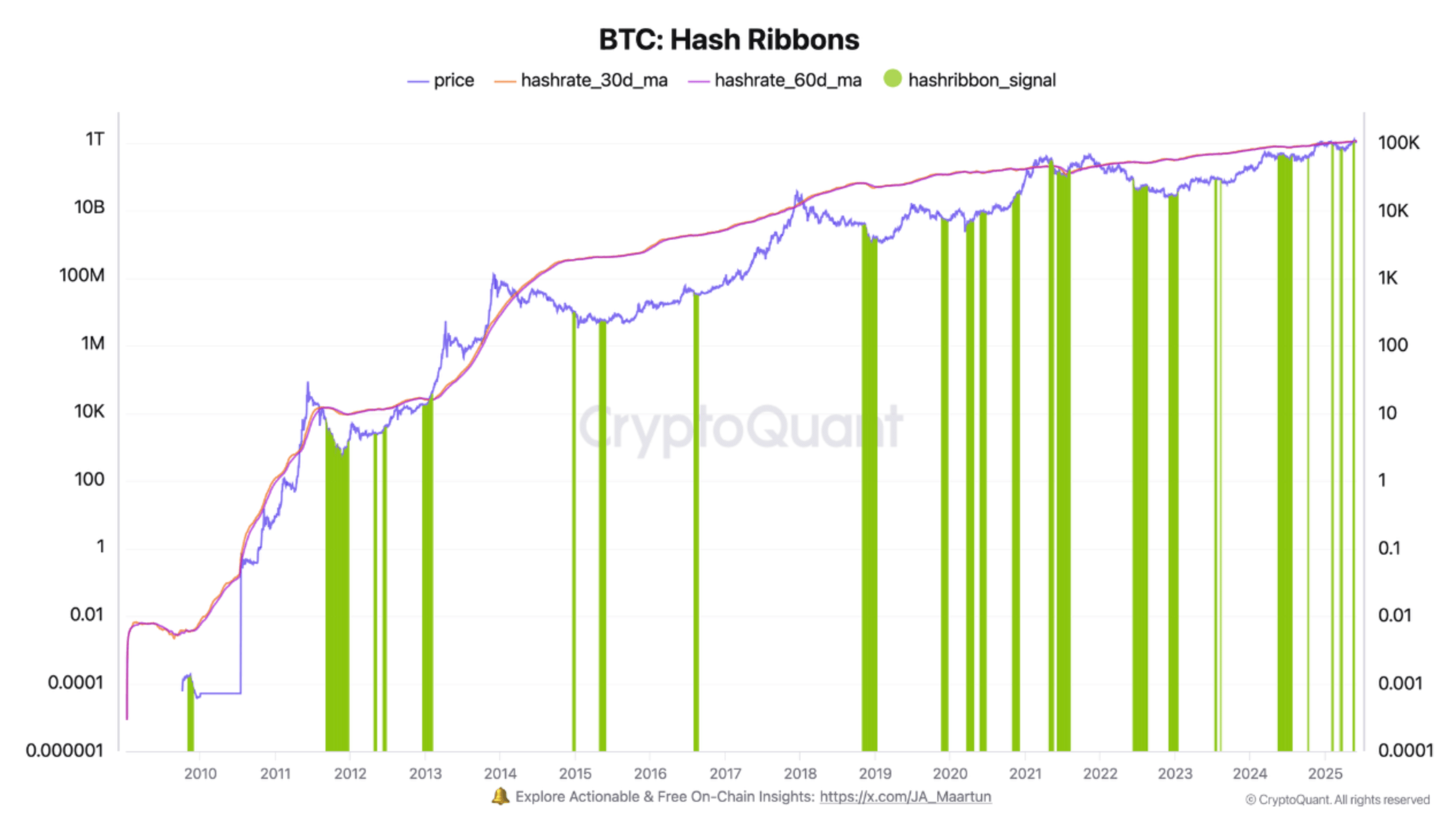

Bitcoin Hash Ribbons Indicating Prime Buying Opportunity, Analyst Says

Bitcoin (BTC) remains range-bound in the mid-$100,000s, showing no clear directional bias. However, ...

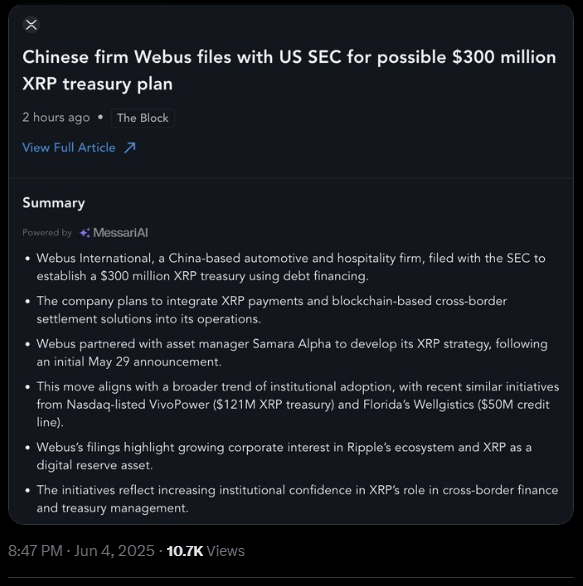

Messari Flags XRP’s Silent Rise As A Treasury Favorite—Here’s Why

Three publicly traded companies are moving to hold XRP as part of their cash stash, putting real mon...

Dogecoin Open Interest Averages $2 Billion In June As Price Struggles Below $0.2

Dogecoin’s open interest is in focus, with this crucial metric highlighting the amount of interest t...