How Will Cryptos Fare in Historically Quiet June?

After a banner performance in May, Bitcoin ran out of gas at the start of June, which is usually known for weak returns for risk assets.

Last month, the token surged to a new all-time high of over $111,000 before paring back gains to trade around $104,000 on Monday. The tapering off in cryptos coincided with a pullback in risk assets, including stocks on US President Donald Trump's trade war uncertainty.

Rising trade tensions and geopolitical unpredictability dampened investor enthusiasm as the new month began, putting downward pressure on global stocks. The narrative of risk-off bets gained traction.

Bitcoin outperformed most major assets in May even as global stocks had a bumper month after sliding on Trump's economic broadsides in April.

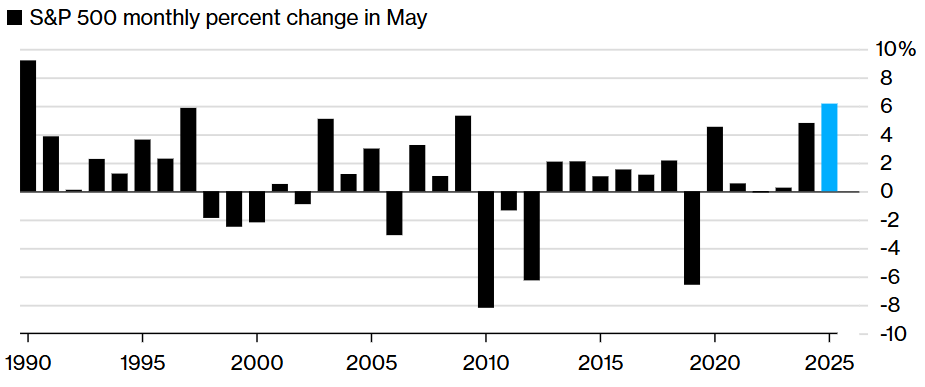

The S&P 500 surged 6% to mark its best May since 1990 and recorded its best month in over a year and a half. The index is about 4% from its all-time high and tells a telling story despite Trump's headlines almost every other day.

Still, the Wall Street benchmark is nearly flat for the year and has had its worst start to a year since the 1950s.

For digital assets, though, 2025 seems to be a good year. Institutional investors are propelling the asset class into mainstream stardom, and the White House's pro-crypto policy administration is helping to boost it.

However, the impact of Trump-induced volatility on cryptos has also been significant.

Seasonality Snag

The old saying goes something like, "Sell in May and go away," to describe the six months leading up to October, when stock bets have typically been a bad idea.

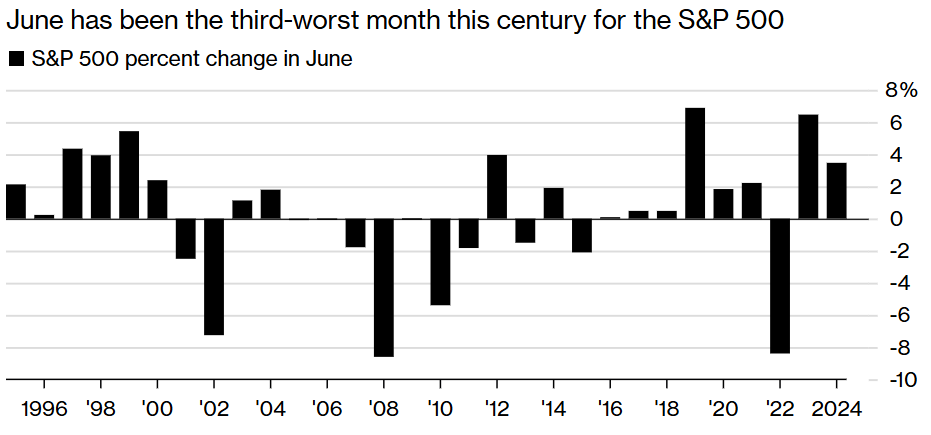

The S&P 500 has averaged an increase of just 1.8% from Memorial Day through Labor Day, dating back to the early 1970s. However, Bloomberg data shows that the S&P 500 has only lost ground in June once in the past 10 years.

The market will be tested when the Federal Reserve announces its interest rate decision on June 18. Just two days after that, we have "triple witching," an event that increases volatility due to the expiration of a significant number of equity-related options. Finally, at the end of the month, we will have quarterly portfolio rebalancing.

These crucial milestones will decide the bulls' ability to continue pushing stocks higher, especially as the S&P 500 approaches 6,000, a significant psychological level.

According to history, stocks in June don't seem to perform well. In the seven decades after a US presidential election, the S&P 500 has usually had a rough start to June as investors cash out their gains for the summer.

This is especially true if stocks have a solid May like they did this year.

Tariffs Thaw Didn't Last Long

The tariff thaw was short-lived. Trump wants a quick phone conference with Chinese President Xi Jinping. Still, the possibility of such a meeting is now remote after China accused the US of breaking their recent trade pact and threatened to defend its interests.

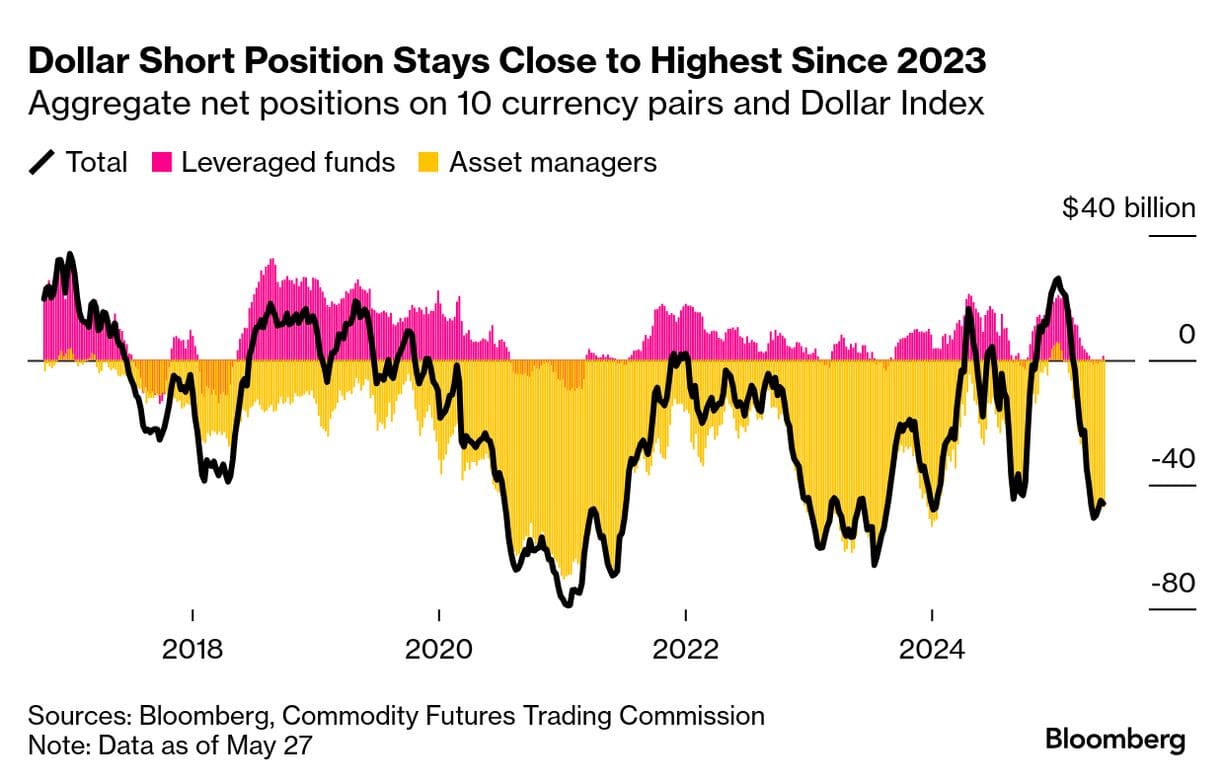

Mounting fears of a protracted trade war weighed heavily on the dollar and stocks at the start of the trading week.

Things aren't looking good for the dollar right now.

As the US economy cools and the Fed lowers interest rates, Morgan Stanley predicted that the dollar might fall by 9% by mid-2026.

Everything points to the fact that the global community is seriously considering ending its dependence on the dollar.

Also, due to the lower interest rate risk associated with short-term debt, some of the largest money managers in the world are avoiding long-term Treasuries.

The outlook for cryptos, though, isn't that downbeat. If anything, digital assets will likely sway sideways and within a tight range.

Bouts of volatility are on the cards, with bets of Bitcoin hitting another ATH also factored in.

Elsewhere

Singapore & the Future of Crypto (11 June)

Join us for a compelling fireside chat on 11 June with Jeremy Tan , entrepreneur and independent GE2025 candidate, as he sits down with Saad Ahmed, Head of APAC at Gemini, to explore what Bitcoin really is, why it matters, and how it could help shape the future of Singapore — and its people.

Whether you're new to Bitcoin, curious about crypto, or eager to understand where the future of money is headed, this is your chance to gain clear, honest insights. No jargon. No hype. Just practical knowledge for everyday Singaporeans.

The event is free to attend, though seats are limited and subject to confirmation. If not approved, you’ll still receive a livestream link to attend online. Apply early to secure your spot!

Blockcast

Licensed to Shill II: M&A Mania, Token Launchpads, the Rise of Bitcoin Corporates

In this episode of Licensed to Shill, Blockcast dives headfirst into the industry's accelerating maturity, turbocharged by eye-popping M&A deals and the convergence of TradFi and crypto. Your host Takatoshi Shibayama is joined by Lisa J.Y. Tan (Economics Design), Nikhil Joshi (Emurgo), and Valentin Fournier (BRN) for a no-holds-barred analysis of the industry's most compelling narratives.

Blockcast is hosted by Head of APAC at Ledger, Takatoshi Shibayama . Previous episodes of Blockcast can be found here , with guests like Davide Menegaldo (Neon EVM), Jeremy Tan (Singapore parliament candidate), Alex Ryvkin (Rho), Hassan Ahmed (Coinbase), Sota Watanabe (Startale), Nic Young (Oh), Jacob Phillips (Lombard), Chris Yu (SignalPlus), Kathy Zhu (Mezo), Jess Zeng (Mantle), Samar Sen (Talos), Jason Choi (Tangent), Lasanka Perera (Independent Reserve), Mark Rydon (Aethir), Luca Prosperi (M^0), Charles Hoskinson (Cardano), and Yat Siu (Animoca Brands) on our recent shows.

Developing Ecosystem, Slowing Momentum - Why We're Bullish, With Caution

Your daily access to the backroom....

Kraken Launches Prime Brokerage Service for Institutional Clients

Platform consolidates trading, custody and financing services as institutional crypto demand grows....

Solana Foundation Partners with Dubai's VARA in Regulatory Collaboration Deal

Agreement establishes framework for regulatory education, talent development, and innovation hub cre...