Bitcoin Hits Exchange Reserve Lows as Bulls Eye $106K Rebound

- Bitcoin exchange reserves have reached a new low, indicating strong accumulation by long-term holders.

- Price is down below $106K, and if buyers can’t regain control, the price could decline a lot more.

- Analysts expect a possible rebound in early June if the $106K resistance breaks soon.

Bitcoin exchange reserves have dropped to new lows, indicating ongoing accumulation from long-term holders and institutional investors. CryptoQuant data indicates Bitcoin exchange reserves have dropped to fresh lows near 2.43 million BTC as they continue their long-term downtrend.

This decline indicates that long-term holders and institutions are still accumulating, which lowers near-term sell pressure. The large reserves drop is consistent with investors’ increasing preference for cold storage and self-custody.

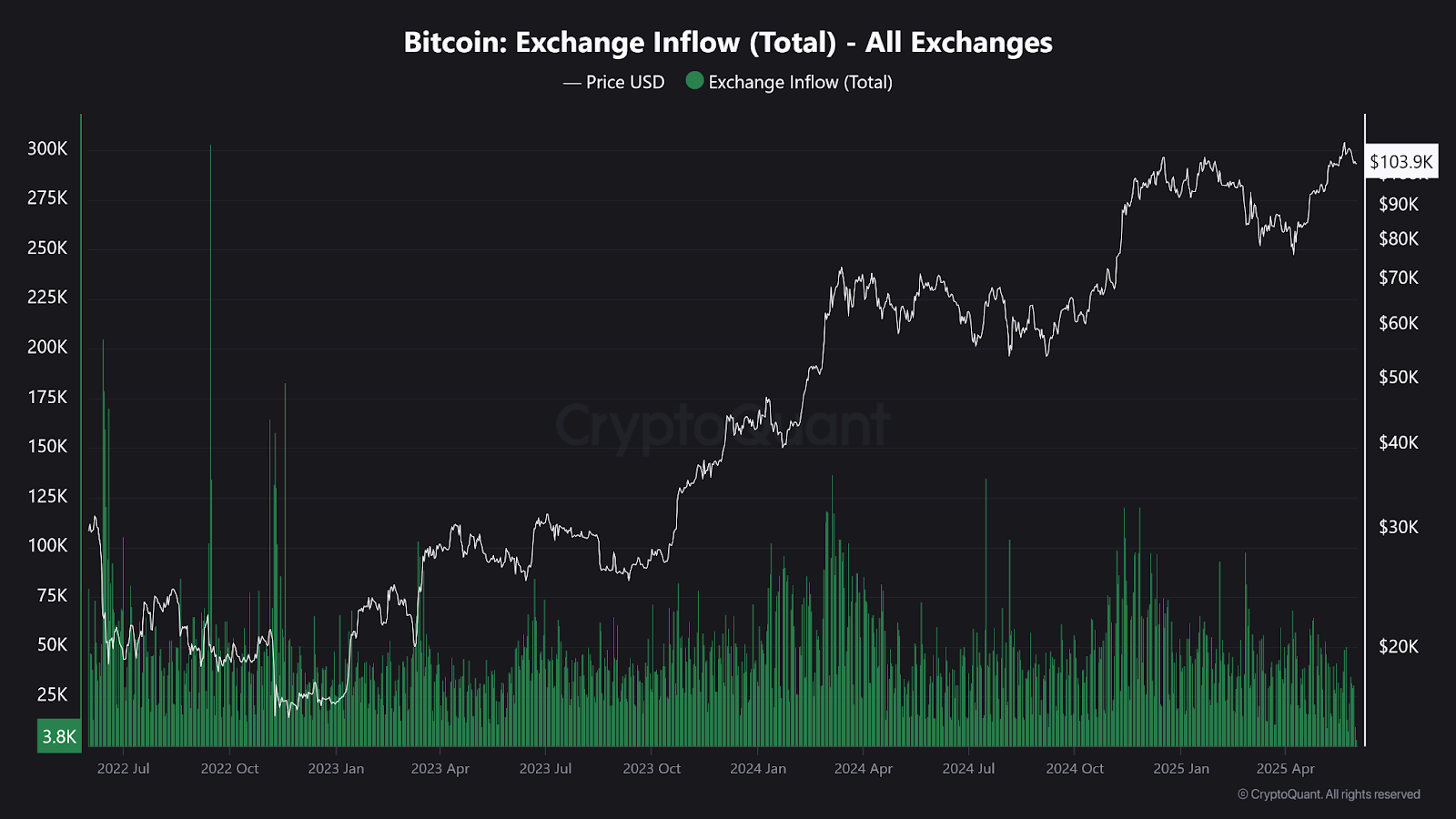

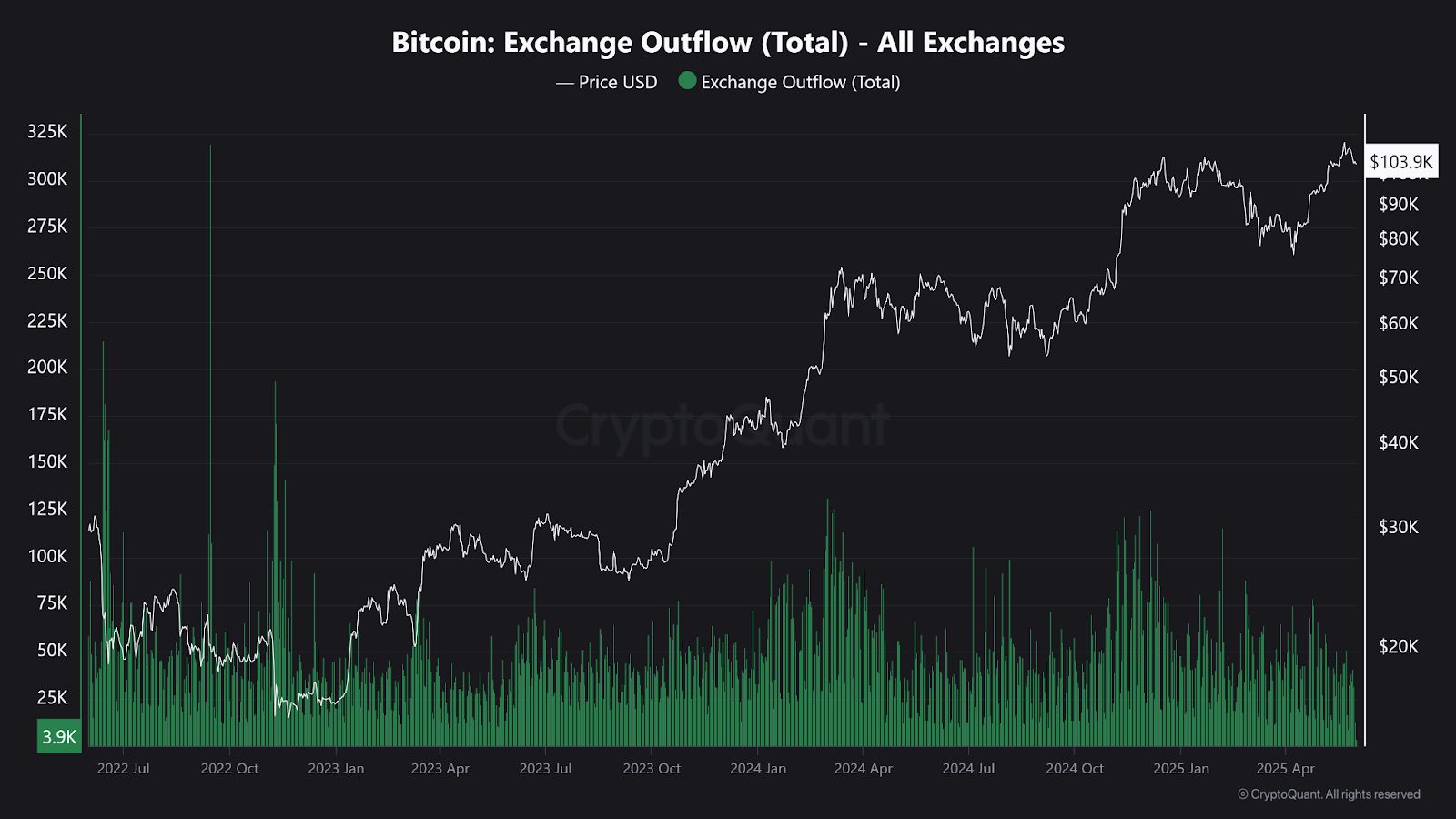

Overall, total exchange inflows are inconsistent, but the latest chart has very lackluster daily inflow activity at 3.8K BTC as the price sits at $104K. The lack of aggressive exchange deposits shows that sellers are retreating. On the other hand, outflows are also high at 3.9K BTC, which supports the bullish thesis of long-term accumulation.

Bitcoin is trading at $104,078 following a loss of 2.60% during the last 24 hours, and selling activity has also slowed. Similarly, daily trading volume is down 2.24%, which indicates less profit-taking play in this current price dip.

Analyst Commentary: June Rebound Still in Sight

Market sentiment is mixed while supply on exchanges declines. According to crypto analyst PattaTrades, Bitcoin has been up over 10% from the first week of each month for the past seven months. He expects the pattern to be repeated in June. The trend may continue in the coming days, and the market might even rebound.

Technical signals, however, show some hesitation. The MACD has turned bearish with a negative histogram, while the RSI has fallen now to reach 50.24 from recent highs. Despite the long-term structure intact, these indicators hint at slowing momentum.

On the four-hour chart, Bitcoin has moved through several price ranges. The next significant ranges for the asset were $93K to $96K and then $101K to $105K after it broke out of ranges of between $83K and $86K. It now tussles between $106K and $112K. Recently, price levels moved back to the lower end of that range, a pullback.

Daan Crypto, a market analyst, said bulls will need to close above $106,000 to avoid further downside. He added that failure to reclaim this level would most likely result in a deeper pullback in the next few weeks. Meanwhile, other analysts believe there’s potential for bearish pressure that could pull the price down to $100K to $102K.

Crypto Controversy Prompts Czech Minister’s Resignation

Cryptocurrency is also making political waves outside of the markets. Czech Justice Minister Pavel Blažek resigned after revelations that his ministry had received a nearly one billion crowns Bitcoin donation from a convicted drug offender.

Blažek, who said he knew nothing about the donor’s background or any illegalities connected to the donation, nonetheless said he was resigning in order to protect the credibility of the administration. The decision was quickly backed by coalition leaders, who stressed the importance of i nstitutional integrity.

Binance Launches ZRC Airdrop Following SEC Case Dismissal

Binance launches ZRC airdrop and trading event as SEC officially dismisses its 2023 lawsuit against ...

Blazpay Partners with ManusPay to Redefine AI-Driven Crypto Payments

Together in this partnership, both Blazpay and ManusPay intend to expedite the digital asset adoptio...

AI Tokens and Meme Coins Rally as Sky and WIF Lead Daily Gainers

Creator.BID leads June 3 gainers with a 62.6% surge as small-cap and DeFi tokens like Syrup, Rocket ...