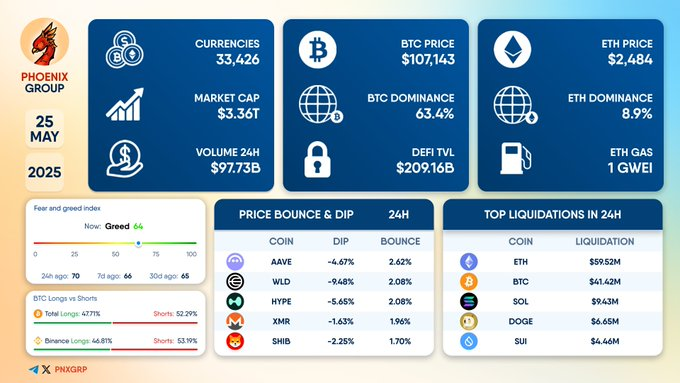

Greed Returns to Crypto Market as Bitcoin Dominates and Derivatives See Heavy Liquidations

- Bitcoin leads with 63.4% dominance as market sentiment shifts into “Greed” territory.

- Ethereum tops liquidations while DeFi TVL rises to $209.16B, signaling strong engagement.

- Altcoins show mixed performance with sharp dips and modest rebounds amid high volatility.

The crypto market closed the trading day on May 25, 2025, with signs of increasing investor confidence, as the Crypto Fear and Greed Index reached 64, placing the sentiment squarely in the “Greed” zone.

The global market capitalization stood at $3.36 trillion, supported by $97.73 billion in 24-hour trading volume across 33,426 tracked digital assets. While Bitcoin remained the clear leader in the market, rising activity in derivatives and major moves among altcoins marked a volatile session.

Bitcoin (BTC) led the market with a price of $107,143 and held a 63.4% share of overall market capitalization. Ethereum (ETH) followed at $2,484, contributing to 8.9% of market dominance. Ethereum’s network conditions remained stable, with gas fees recorded at only 1 Gwei, reflecting low congestion and relatively smooth transaction flow.

In decentralized finance (DeFi), total value locked (TVL) rose to $209.16 billion. The figure pointed to steady involvement from institutional and retail participants alike. Despite price fluctuations among several major tokens, core blockchain metrics showed consistent engagement levels, particularly across DeFi protocols.

Derivatives Market Activity Signals Higher Risk Appetite

Liquidation data showed major action in the derivatives market. Ethereum accounted for the highest liquidation value at $59.52 million, followed by Bitcoin with $41.42 million. Solana (SOL) posted $9.43 million in liquidations, while Dogecoin (DOGE) and Sui (SUI) recorded $6.65 million and $4.46 million, respectively.

Long positions outpaced short trades across the broader market, making up 52.97% of all activity. On Binance, however, the trend reversed, with short positions representing 53.99% of total trades. The variance between exchanges indicated mixed market sentiment, with traders adjusting strategies based on localized risk expectations.

Altcoin Prices Show Mixed Reaction to Volatility

During the session, the performance of altcoins differed greatly. At one point, AAVE trade value dipped 4.67%, but afterward, it gained 2.62% and ended up being the most promising in the group. Worldcoin suffered the steepest decline, losing 9.48% of its value, ahead of Hype, which fell 5.65%.

Monero (XMR) initially fell in price by 1.63%, but it later recovered by 1.96%. Shiba Inu (SHIB) started with a 2.25% drop but rallied back with a 1.70% gain during the same day. The reductions showed that many smaller-cap and meme-related assets were affected by general market swings.

With Bitcoin maintaining dominance and DeFi showing continued engagement, the immediate focus remains on whether current trading volumes and positioning will lead to breakouts or trigger a broader correction. Despite the rising greed sentiment, market behavior continues to show caution amid ongoing liquidation events and mixed altcoin performance.

SUI Hack Latest News, Solana Price Prediction & Everything You Need To Know About Mantix

After SUI’s $223M hack, fear spreads in DeFi. As Solana eyes $200, Mantix gains traction with safer,...

Bitcoin Vs Bitcoin Cash; Find Out The Different As Traders Look To Pounce On New Opportunity Mantix

Volatility returns as whales weigh options. While Bitcoin surges, Mantix emerges as a top DeFi conte...

Best Cryptos to Buy This Month? Arbitrum Had Its Run—Now All Eyes Are on Qubetics

Missed Arbitrum? Qubetics is gaining traction fast with real utility, rising presale, and massive RO...