Altcoin Withdrawals Accelerate on Binance as Accumulation Trend Builds

- Small-cap altcoins see consistent outflows as users shift assets to self-custody.

- Ethereum joins top withdrawn tokens despite its large-cap status and market activity.

- Reduced exchange balances hint at lower sell pressure but potential for future volatility.

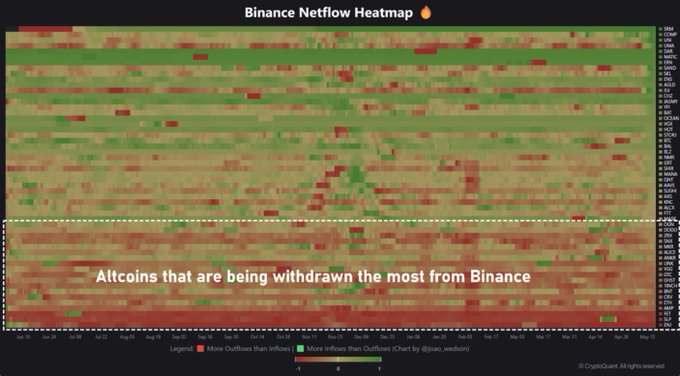

Increased altcoin withdrawals from Binance are drawing attention across the crypto market as on-chain data points to growing user interest in moving assets off centralized exchanges. According to a recent Binance Netflow Heatmap shared by on-chain analyst @joao\_ndeison, the trend of sustained outflows, particularly among lower-cap tokens, has been ongoing between March and May 2025.

The heatmap, which visualizes netflows of altcoins on Binance, uses color to track asset movement: red marks more outflows than inflows, while green indicates the reverse. The data reveals a strong cluster of red shades in the lower section of the heatmap, reflecting consistent net outflows for smaller altcoins over the past two months.

Tokens with lower market capitalization are showing the strongest withdrawal signals. Assets such as SafePal (SFP), Bancor (BNT), Origin Protocol (OGN), eCash (XEC), and WAX (WAXP) have seen sustained outflows, suggesting reduced availability on Binance. The pattern reflects investor preference for moving these tokens to self-custody, which may be linked to growing caution around centralized platforms or a long-term holding strategy.

The consistent outflows suggest that users are pulling their assets into private wallets rather than keeping them on exchanges. While the motivations behind these moves are not explicitly outlined in the data, they align with a broader behavioral shift observed during previous periods of market stress or anticipated market rotation.

Large-Cap Assets Display Stability

By contrast, higher-cap assets like Bitcoin (BTC), Ethereum (ETH) , Solana (SOL), and Binance Coin (BNB) present a more balanced pattern of inflows and outflows. The upper part of the heatmap shows alternating green and red colors, indicating a relatively stable netflow. These assets remain actively traded and do not currently show the same scale of net withdrawals as seen in smaller tokens.

Ethereum, however, remains a major exception. Despite price swings in recent months, ETH is among the top withdrawn tokens on Binance. This continued off-exchange movement reflects sustained accumulation interest in Ethereum and a possible reduction in short-term sell pressure.

Most Accumulated Altcoins Identified

Beyond SFP, BNT, and OGN, several other tokens have emerged with significant withdrawal activity. Some of the DeFi coins in this category are Enjin (ENJ), Smooth Love Potion (SLP), Fetch.ai (FET), Amp (AMP), Curve (CRV), 1inch (1INCH), Aavegotchi (GHST), Gitcoin (GTC), Yield Guild Games (YGG), Chainlink (LINK), Ankr (ANKR), MyNeighborAlice (ALICE), Maker (MKR), Synthetix (SNX), 0x (ZRX), and DODO.

If this flow toward these altcoins on Binance continues, liquidity on the exchange could experience some challenges. Smaller exchange balances can mean that selling is reduced, and when demand rises again, the market may experience higher volatility.

Top Rated Cryptocurrencies Right Now: Web3 ai’s $777K Giveaway, VET, PEPE, and HBAR

Discover the top rated cryptocurrencies for 2025, led by Web3 ai and its $777,000 giveaway for 10 wi...

Crypto.com Achieves Major Milestone with MiFID Licence for Expanded Investment Services in the EEA

Crypto.com’s new acquisition of Markets in Financial Instruments Directive (MiFID) license means it ...

$10M in Sight for Unstaked Presale as Cardano Aims Higher and Tron Investors Celebrate Profits

Unstaked crosses $6.4M with 28x upside and a $1M Gleam giveaway, while Cardano approaches resistanc...