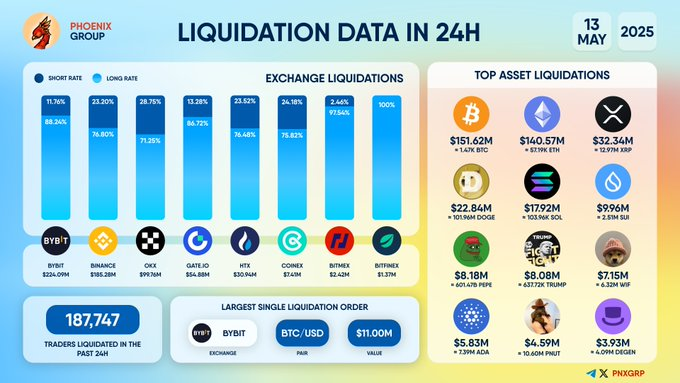

Over $600 Million in Crypto Liquidations as Bitcoin, Ethereum Lead May 13 Sell-Off

- Over 187,000 traders liquidated as crypto losses exceed $600 million in 24 hours.

- Bitcoin and Ethereum top liquidation list with $292 million combined losses.

- Bybit leads exchanges, recording $320 million in liquidations and a single $11M BTC order.

Over $600 million in crypto positions were liquidated on May 13, 2025, marking one of the most considerable single-day losses in the second quarter. Data from Phoenix Group confirmed that 187,747 traders saw their leveraged positions wiped out amid heightened market volatility. The event affected major digital assets and exchanges, signaling an abrupt shift in market sentiment after earlier optimism in May.

Bybit emerged as the platform with the highest liquidation volume, reporting losses totaling $320.69 million in a 24-hour span. The exchange also recorded the largest individual liquidation order of the day, an $11 million position involving the BTC/USD trading pair. Notably, 88.36% of liquidations on Bybit impacted short positions, reflecting a concentrated wave of bearish bets being closed out.

On other platforms, long positions were more severely affected. Binance followed Bybit with $192.89 million in total liquidations, while OKX recorded $92.76 million. HTX also saw significant liquidation activity, with 76.42 percent of those involving long-side positions. These figures suggest varying sentiment across exchanges, with some traders betting on a continued rally while others braced for a decline.

Bitcoin and Ethereum Lead the Sell-Off

Bitcoin led all assets in liquidation value, with $151.62 million erased during the sell-off, representing approximately 1.43 thousand BTC. Ethereum followed with $140.57 million in liquidated positions. XRP posted $32.34 million in liquidations, with Dogecoin and Solana trailing at $22.84 million and $17.92 million, respectively.

The data also showed that meme coins were not spared. PEPE recorded $8.18 million in liquidations, while TRUMP followed closely with $7.15 million. These figures indicate that traders exposed to speculative assets experienced substantial losses alongside major cryptocurrencies.

Even with consistent early May gains, traders with high leverage were not prepared for the volatility which came up sharply in major spot and derivatives markets. The market movements on May 13 indicate increased risk levels and lightning reversal of sentiments.

The overwhelming effect on the leveraged traders shows the frail construction of the cryptocurrency markets at the moment. Combined with volatile movement in prices, high-risk positions were part of one of the largest liquidation events 2025. With such priceless possessions such as Bitcoin and Ethereum at the core of the activity, the event underlined the superiority of these assets in open interest, and their role in the general market behaviour.

DeFi Development Corp Acquires 172,670 $SOL, Elevating Total Holdings above $100M

DeFi Development Corp has acquired 172,670 more $SOL, expanding total holdings past $100M and solidi...

BNB Price Prediction Charts 5-Year Growth Path, While Qubetics Becomes the Best Crypto Presale of 2025

BNB eyes long-term gains toward $841 by 2030, while Qubetics emerges as 2025’s top crypto presale wi...

Multisynq Taps Chainlink BUILD to Advance Real-Time Application Layer

The collaboration aims to expedite the adoption of real-time application layer of Multisynq via resi...