Strategy Acquires 1,895 BTC in Latest Purchase, Expands Bitcoin Holdings to Over 555,000

Favorite

Share

Scan with WeChat

Share with Friends or Moments

Strategy, formerly known as MicroStrategy, has confirmed another addition to its growing Bitcoin reserves, acquiring 1,895 BTC for $180.3 million.

This latest acquisition pushes the company's total holdings to 555,450 BTC. Chairman Michael Saylor highlighted the purchase through a post on X.

https://twitter.com/saylor/status/1919362210804990383

Latest Acquisition Follows $1.4 Billion Bitcoin Buy

Notably, this $180 million acquisition is modest compared to last week’s $1.4 billion purchase. Still, it fits into the company’s consistent pattern of strategic buying. Since its inception of Bitcoin purchases, Strategy has significantly ramped up its buying activity, especially following the U.S. 2024 elections.

At an average purchase price of $68,550 per BTC, the company has now invested approximately $38.08 billion in Bitcoin. With the market price of Bitcoin currently exceeding $94,000, Strategy holds an unrealized profit estimated at more than $14 billion.

The timing of the latest purchase aligns with the company’s ongoing capital deployment plan. Just days prior, Strategy

unveiled

a $42 billion funding program. This initiative includes a $21 billion common stock issuance and an additional $21 billion through fixed-income instruments. The funds aim to expand Bitcoin holdings and increase yield targets throughout 2025.

Saylor Signals Continued Accumulation Strategy

While no longer CEO, Michael Saylor continues to play a visible role in Strategy’s direction. On Sunday, he

hinted

at the upcoming buy by pointing to a chart on SaylorTracker, noting the lack of "orange dots" used to represent BTC purchases.

His messaging comes amid comments reiterating his belief in persistent and large-scale acquisitions. He recently stated plans to continue purchasing even if Bitcoin reaches a price of $1 million per coin.

https://twitter.com/coinbureau/status/1919314657757495319

According to Saylor, acquisitions could scale to $1 billion per day depending on market conditions and availability.

Future Approach as Liquidity Concerns Emerge

This posture toward aggressive acquisition has prompted industry discussions about the future of Bitcoin supply. Richard Byworth, a partner at Syz Capital and adviser to Jan3, speculated on whether Saylor’s current acquisition method would remain viable if supply tightens significantly.

He proposed that the company could consider acquiring firms and using their treasury assets for future Bitcoin purchases. This approach, he noted, might offer a more efficient path in a scenario where OTC liquidity dries up.

Disclaimer: This article is copyrighted by the original author and does not represent MyToken’s views and positions. If you have any questions regarding content or copyright, please contact us.(www.mytokencap.com)contact

About MyToken:https://www.mytokencap.com/aboutusArticle Link:https://www.mytokencap.com/news/503938.html

Related Reading

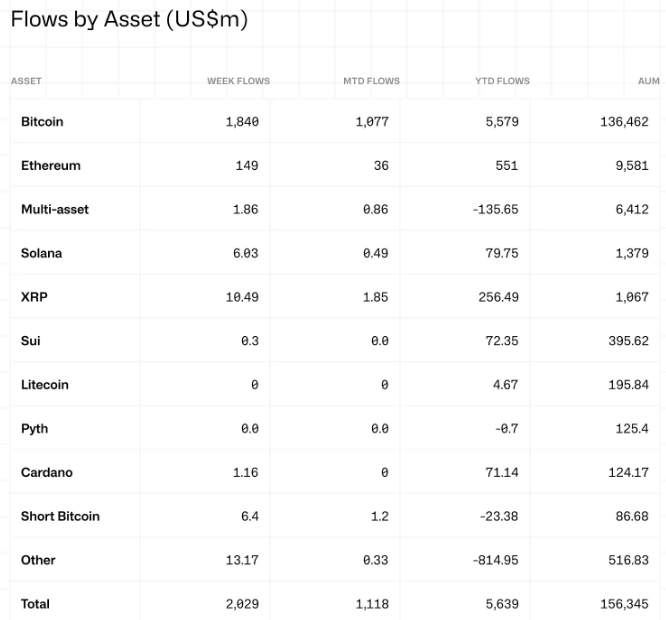

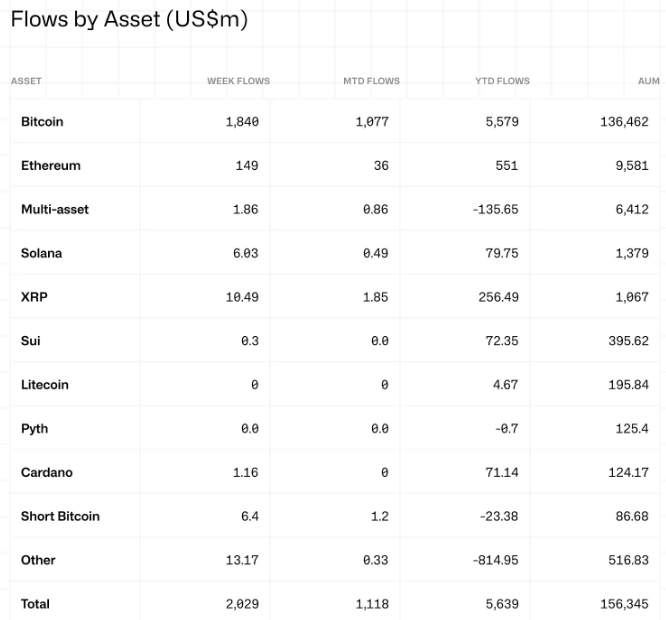

Bitcoin Leads as Crypto Investment Products Record $2B in Net Inflows

Investment products tied to cryptocurrencies registered their third consecutive week of inflows, wit...

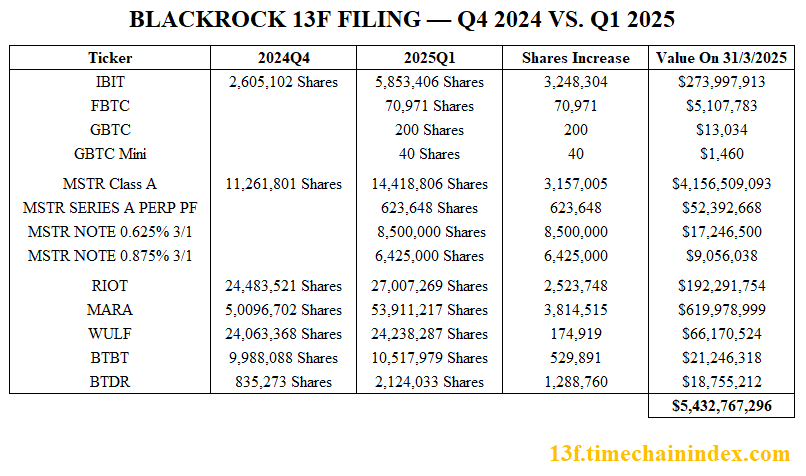

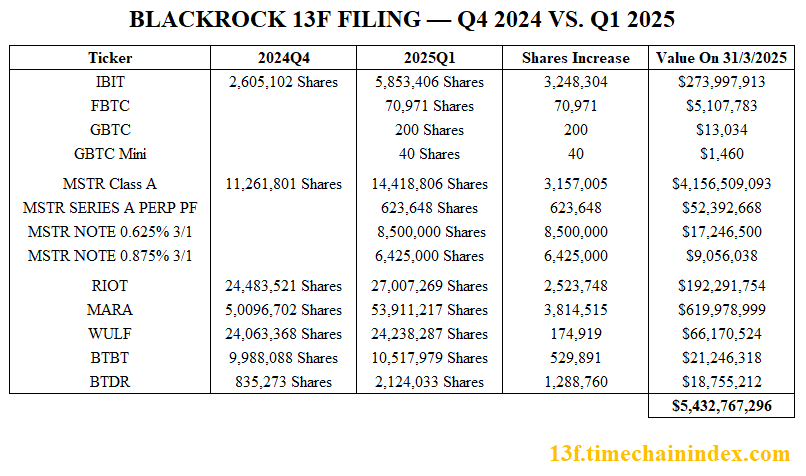

BlackRock Holds Over $5B in Bitcoin Stocks, With $4.23B in Strategy Alone, Latest Filing Shows

BlackRock's latest 13F filing for Q1 2025 reveals a significant uptick in its Bitcoin exposure. Th...

Bernstein: Public Firms Projected to Allocate $330 Billion into Bitcoin by 2029

Public companies could channel over $300 billion more into Bitcoin over the next five years, accordi...