The post Crypto Market Today [Live] Updates On December 2,2025 appeared first on Coinpedia Fintech News

December 2, 2025 06:06:21 UTC

Bank of America Signals Early Rate Cuts but Limited Room Ahead

Bank of America expects the Fed to deliver a rate cut next week but warns this front-loads most of the easing. If the Fed cuts a total of 0.75% by year-end, only about 0.5% of room would remain for 2026. BofA says early cuts could push policy into accommodative territory just as new fiscal stimulus kicks in, reducing the Fed’s flexibility later. The message: more easing now means less available later.

December 2, 2025 05:57:01 UTC

Bitrue Lists ESPORTS Token

Bitrue is adding $ESPORTS to its spot market, with deposits now open through the BSC network. Trading for the ESPORTS/USDT pair begins on December 1 at 12:00 UTC. The token is part of Yooldo, a multi-chain Web3 gaming platform designed to make onboarding easier with a CEX-style interface while still offering true digital ownership through NFTs and token-based assets. A fresh opportunity for gamers and Web3 users arrives this week.

December 2, 2025 05:54:47 UTC

Trump Poised to Announce New Fed Chair This Week

Trump is expected to reveal his Fed Chair pick before Christmas, with sources — including Treasury Secretary Scott Bessent — saying the decision is already made. Trump hinted on Air Force One that the announcement could come as early as December 2–3. Betting markets place Kevin Hassett at roughly 75% odds. If chosen, Hassett would bring a pro-growth, dovish approach favoring quicker rate cuts, higher inflation tolerance, and a softer dollar — a setup historically bullish for stocks and crypto.

December 2, 2025 05:39:17 UTC

Fed Moves to Neutral: Data Dependency Opens Door for Crypto Upside

Powell emphasized that policy is now data-dependent rather than biased toward tightening. With the economy holding up, inflation falling, and no urgency to restrict credit, the Fed has shifted from defense to neutral. His references to historical policy discipline hint at a long period of stability ahead. For crypto, this is the sweet spot: steady growth, easing financial pressure, and a more predictable macro environment, conditions that typically fuel stronger momentum and adoption.

December 2, 2025 05:38:03 UTC

Liquidity Tailwind Returns: What Ending QT Means for Crypto

Powell’s announcement marks a major pivot: liquidity is no longer being pulled from the system. Banks and funds can expand positions again, and financial conditions should naturally ease. Risk assets depend on liquidity — and crypto is the most sensitive to it. With QT over and reserves set at “ample” levels, the environment flips from restrictive to supportive. This macro turn could trigger stronger flows into digital assets as capital becomes more flexible.

December 2, 2025 05:36:51 UTC

Fed Ends QT After Shrinking Balance Sheet by $2.4 Trillion

The biggest reveal was Powell confirming that quantitative tightening ended on December 1. The Fed’s balance sheet runoff from $9T to $6.6T is now paused. He said reserves will stabilize around $3 trillion, calling it “ample liquidity.” This shift is huge. Ending QT stops liquidity drain and stabilizes funding. For risk markets, especially crypto, this removes a major headwind and replaces it with the first real liquidity tailwind in over a year.

December 2, 2025 05:35:25 UTC

Fed Signals Stability: Powell Says Economy Now “On Firmer Ground”

Jerome Powell opened by declaring the U.S. economy stronger than it has been in years. Growth held near 2.5% in Q3, unemployment sits at 4.1%, and recession risks have faded. With stability returning and no justification for further tightening, markets finally get clarity after two years of uncertainty. For crypto, a steady macro backdrop removes one of the biggest headwinds and sets the stage for renewed confidence and healthier risk appetite.

December 2, 2025 05:33:37 UTC

Coinbase 50 Index Adds Six New Tokens in Latest Rebalancing

Coinbase Institutional has updated its Coinbase 50 Index for the fourth quarter, adding six new assets: HBAR, MANTLE, VET, FLR, SEI, and IMX. At the same time, six tokens were removed from the index, including SKL, AKT, LPT, SNX, HNT, and CVX. The COIN50 Index tracks the top assets on Coinbase by market size and liquidity, and the latest changes reflect shifting market demand and trading activity.

December 2, 2025 05:32:45 UTC

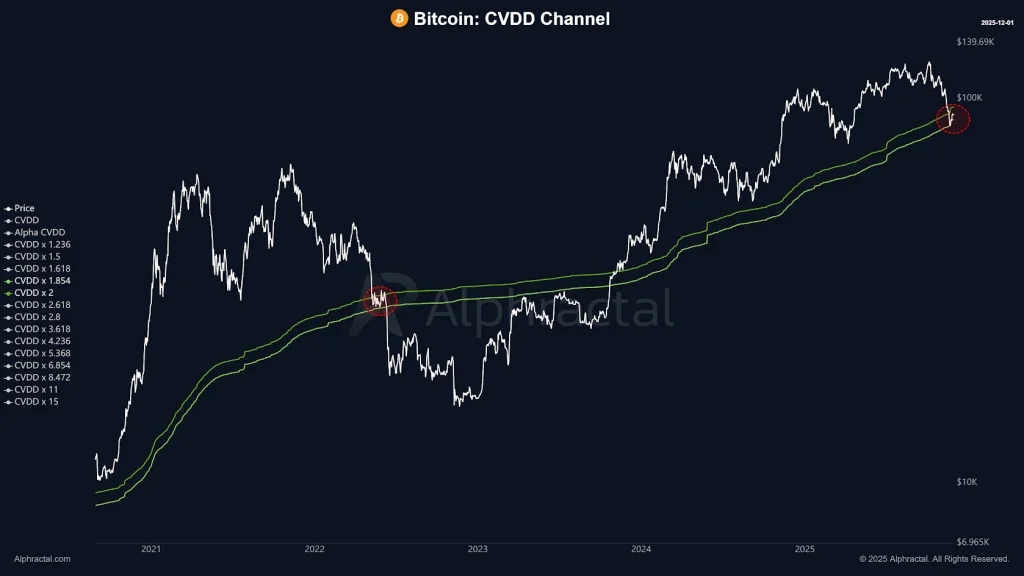

Bitcoin’s History Sends a Clear Warning

Bitcoin has gone through five major bull cycles, and every single time the main parabolic run has broken, a big correction followed — at least 75%. There has never been an exception. If the current move breaks its long-term trend, history suggests a similar deep pullback could follow. Betting against this pattern means assuming Bitcoin will behave differently this time, and that’s a tough case to make without a very strong reason.

December 2, 2025 05:21:18 UTC

Vanguard Finally Opens the Door to Crypto ETFs

Vanguard has reversed its long-standing stance and will now allow clients to trade spot crypto ETFs on its brokerage platform. Investors can access Bitcoin, Ethereum, XRP, and Solana ETFs for the first time through Vanguard. However, the company made one thing clear: it has no plans to launch its own crypto ETFs. This move simply gives users more flexibility while Vanguard maintains its conservative approach to managing digital-asset products.

December 2, 2025 05:21:18 UTC

Bitcoin Price Analysis

Bitcoin is sitting on a crucial support level , the same kind it lost back in 2022 before a bigger drop followed. The key number to watch now is $88,000. Staying above it keeps the market healthy. Falling below it could push BTC toward $76,800, or even $71,250 if pressure increases. These are areas where buyers usually step in. One long-term indicator also shows deep support around $47,450, which could matter in the next major market cycle.

New Listing

New Listing

Deposits opened via

Deposits opened via

Update: The

Update: The

(@CoinbaseInsto)

(@CoinbaseInsto)