Institutional Solana Buying Ramps Up: The Nearly $600 Million Buy Shaking Up SOL

Solana is seeing a sharp rise in institutional demand , with publicly traded companies now holding over $591 million worth of SOL. According to new data from CoinGecko, four firms—Upexi, DeFi Developments Corp, SOL Strategies, and Torrent Capital—have collectively acquired more than 3.5 million SOL, marking one of the strongest waves of corporate accumulation in the asset’s history.

Solana Sees Massive Institutional Buying Spree

Institutional appetite for Solana is accelerating at a pace not seen before, signaling a shift in market sentiment as major players seek exposure to SOL. A new report by CoinGecko reveals that four publicly listed companies have collectively acquired more than 3.5 million SOL, now valued at over $591 million.

Leading the pack is Upexi, a Solana treasury company . Since late April 2025, Upexi has acquired 1.9 million SOL at an average cost of $168.63 per token, investing approximately $320.4 million. According to CoinGecko, the company’s position is currently valued at $319.5 million, slightly down by $0.9 million. However, the entire amount is staked, earning an 8% annual yield as of June 30.

Close behind is DeFi Developments Corp , an AI-powered online platform, with approximately 1,182,685 SOL in its treasury. The company has maintained an aggressive pace of accumulation , most recently adding 181,303 SOL on July 29 at an average price of $155.33 per token. CoinGecko reveals that DeFi Dev Corp acquired its total position at an average price of $137.07, making its holdings now worth $198.9 million, with an unrealised gain of $36.8 million.

SOL Strategies, a Toronto-based investment firm, holds 392,667 SOL, acquired steadily from mid-2024 to July 2025. Purchased at an average price of $158.12, the company’s position is now worth $66 million, reflecting a $3.9 million gain. Finally, Torrent Capital, a publicly traded investment company, has acquired 40,039 SOL. CoinGecko notes that the firm bought its Solana holdings in 2025 at an average price of $161.84. Now valued at $6.7 million, this smaller but well-timed bet is sitting on a profit of approximately $0.2 million.

Overall, these four companies control roughly 0.65% of Solana’s circulating supply and about 0.58% of its total supply.

How Public Companies Are Buying SOL

Moving forward, CoinGecko also reveals important details on how each company approaches its SOL allocation. While all four companies’ methods of accumulation differ, they share a growing confidence in Solana’s long-term prospects .

According to the report, Upexi moved quickly, building the largest SOL treasury within four months and signaling a high-conviction and long-term bet. DeFi Developments Corp has taken a more tactical approach, adding to its position during market dips while remaining committed to holding.

On the other hand, SOL Strategies built its stake gradually over 13 months through dollar-cost averaging and staking rewards, reflecting a disciplined, long-term strategy. Lastly, Torrent Capital took on a more strategically timed move, securing gains ahead of Solana’s rally in 2025.

Bitcoin Faces A Black Swan — Bitwise Sounds The Alarm

Last Friday’s US July Employment Situation release has delivered the kind of statistical jolt that r...

Dubai Sets Global Precedent As VARA Approves First Crypto Options License

Dubai has officially cemented its position at the forefront of global crypto regulation. This bold r...

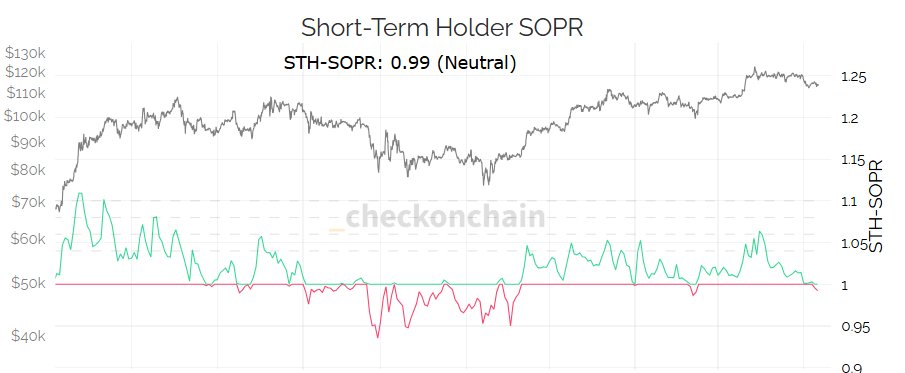

Bitcoin Short-Term Holders Are Capitulating—Will June Pattern Repeat?

On-chain data shows that the Bitcoin short-term holders have switched to loss-taking recently. Here’...